Wall Street has spent the past few weeks sounding the alarm over a potential AI bubble, with concerns mounting that the market’s most powerful trade may finally be showing cracks. Valuations across parts of the tech sector have stretched to extremes, many AI-exposed names have stumbled, and investors are increasingly questioning whether the relentless enthusiasm for AI has gone too far.

Against this backdrop of rising caution, one signal has drawn particular attention: Warren Buffett is selling Apple (AAPL) stock. According to Berkshire Hathaway’s latest 13F filing, the firm trimmed its position in Apple by roughly 15% in the third quarter. At one point, Apple made up more than half of Berkshire’s entire portfolio, a rare level of concentration for the usually conservative value investor. So anytime the Oracle of Omaha pares back such a major position, the market takes notice.

With that, let’s break down what’s behind Buffett’s move—and whether Apple investors should be worried.

About Apple Stock

Founded in 1976, tech giant Apple has consistently set the benchmark in the technology sector. The company’s lineup includes flagship products like the iPhone, MacBooks, Apple Watch, AirPods, and iMacs—all integrated within the ecosystem of its highly profitable Services business. AAPL’s market cap currently stands at $4.01 trillion, making it the second-largest company in the world.

Shares of the iPhone maker have gained 9% on a year-to-date (YTD) basis. Earlier this year, AAPL stock struggled, failing to stage a meaningful rebound after the “Liberation Day” selloff and spending most of the summer trading sideways, partly because its long-term AI strategy failed to capture investor imagination. Still, the stock broke out of that range in August and has been trending higher since then, supported by strong iPhone demand. And the company’s relatively modest spending on AI initiatives appears to be shielding it from the selloff in AI-related stocks.

Warren Buffett Cut His Apple Stake Again in Q3

At one point, Apple accounted for more than half of Warren Buffett’s Berkshire Hathaway’s entire investment portfolio. However, management has been trimming that position to free up cash and redirect capital into other businesses. Berkshire continued this trend in the third quarter, according to the company’s latest 13-F filing. The report, released in mid-November, outlined the firm’s equity holdings in U.S.-listed securities as of Sept. 30.

Berkshire unloaded 41.8 million AAPL shares, roughly 15% of its stake, marking the second consecutive quarter it has reduced its position in the iPhone maker. Notably, its stake in Apple has fallen from around 900 million shares at the end of 2023 to 238 million by the end of September. Still, Apple remains Berkshire’s largest holding, making up 22.7% of the conglomerate’s investment portfolio.

Well, I don’t think Berkshire’s decision to sell Apple stock comes as much of a surprise, since this trend has been underway for a while. It’s also worth noting that the only stock Berkshire added to its portfolio in the third quarter was Alphabet (GOOG) (GOOGL). Berkshire bought $4.3 billion worth of the Google parent stock last quarter. And it appears to be a pure value play—true to Warren Buffett’s style—as trimming the Apple stake provided most of the cash used to buy Alphabet. For context, Apple shares currently trade at 32.94 times forward adjusted earnings, while Alphabet trades at 28.54 times. And in the third quarter, that valuation gap was even wider.

With that, all I’m saying is that Berkshire’s latest move doesn’t raise any red flags for me when it comes to Apple.

Are AI Bubble Fears a Reason for Apple Investors to Worry?

Investor concerns over heavy AI spending and lofty tech valuations don’t appear to be easing, even after a blowout earnings report from AI bellwether Nvidia (NVDA). Most of the Magnificent Seven stocks, a group of tech giants seen as major beneficiaries of AI’s future potential, have come under significant pressure recently. At the same time, Apple has been holding up far better than most of its Mag 7 peers.

Apple’s relatively modest spending on AI initiatives appears to be shielding it from the selloff in Big Tech stocks. Ironically, just a few months ago, the company was widely criticized for not spending heavily on AI and risking falling dangerously behind its Big Tech rivals. Apple reported fiscal 2025 capital expenditures of $12.72 billion on Oct. 30. That’s a far smaller figure than several other mega-cap tech companies that have committed to investing tens of billions in AI.

“Everybody wants to criticize Apple for not really having an AI strategy. But they’re exhibiting great capital discipline. If you’re worried about the circular financing and overspending, Apple is sidestepping all of that,” according to Que Nguyen, chief investment officer of equities strategies at Research Affiliates.

With that, it doesn't look like Apple investors have much reason to worry about an AI bubble. Notably, Apple and Alphabet are the only members of the Magnificent Seven megacap tech group whose shares have gained in November. This suggests they may be well-positioned not only to withstand a potential AI bubble deflation but also to thrive in its aftermath.

A Look at Apple’s Q4 Results

Now that we’ve established that AI bubble fears aren’t something AAPL investors should be overly worried about, let’s turn our focus to the company’s fundamentals. The tech giant’s fiscal fourth-quarter total revenue rose 7.9% year-over-year (YoY) to $102.47 billion, topping Wall Street estimates by $220 million. Though the top-line beat was the smallest in two years. The company’s earnings climbed to $1.85 per share, beating expectations by $0.08.

Still, investor enthusiasm over the solid headline numbers was tempered by two concerning points in the report. First, although iPhone revenue, the company’s largest moneymaker, grew 6.1% YoY to $49 billion thanks to the new models, it still came in below the $49.3 billion consensus estimate. Second, revenue from Greater China dropped 3.6% YoY to $14.5 billion last quarter, far below the $16.4 billion analysts had expected. The good news is that management signaled they expect growth to return in China and overall sales to rise at a faster-than-anticipated pace this quarter.

And signs are already emerging that sales in China are performing well, with iPhone sales up 22% in the first month following the iPhone 17 launch compared with a year earlier, according to Counterpoint Research data released in mid-November. Separate data released last week showed that Apple’s iPhone made up one out of every four smartphones sold in China in October, with sales surging 37% YoY on strong demand for the iPhone 17 series. The figures support management’s expectation that the company will return to growth in China this quarter.

Turning to other parts of the business, services revenue hit a new all-time high, and both the Mac and wearables segments outperformed expectations, helping to offset the slowdown in China. More precisely, services revenue climbed 15% YoY to $28.8 billion, making it Apple’s fastest-growing segment last quarter. Mac revenue rose 13% YoY to $8.73 billion, fueled by strong demand for the MacBook Air, which was refreshed in March and received a $100 price cut. The wearables segment brought in $9 billion in revenue, down 0.3% YoY but still well above analyst expectations.

Meanwhile, tariffs added $1.1 billion in expenses in the quarter, in line with the company’s expectations. Apple anticipates $1.4 billion in tariff costs for the current quarter.

Looking ahead, Chief Financial Officer Kevan Parekh said on the earnings call that total sales are expected to grow 10% to 12% in the December quarter, far above the 6% analysts had projected. Analysts tracking the company currently anticipate a 10.78% YoY increase in EPS to $2.66 for FQ1, while revenue is expected to rise 11.03% YoY to $138.02 billion.

What Do Analysts Expect for AAPL Stock?

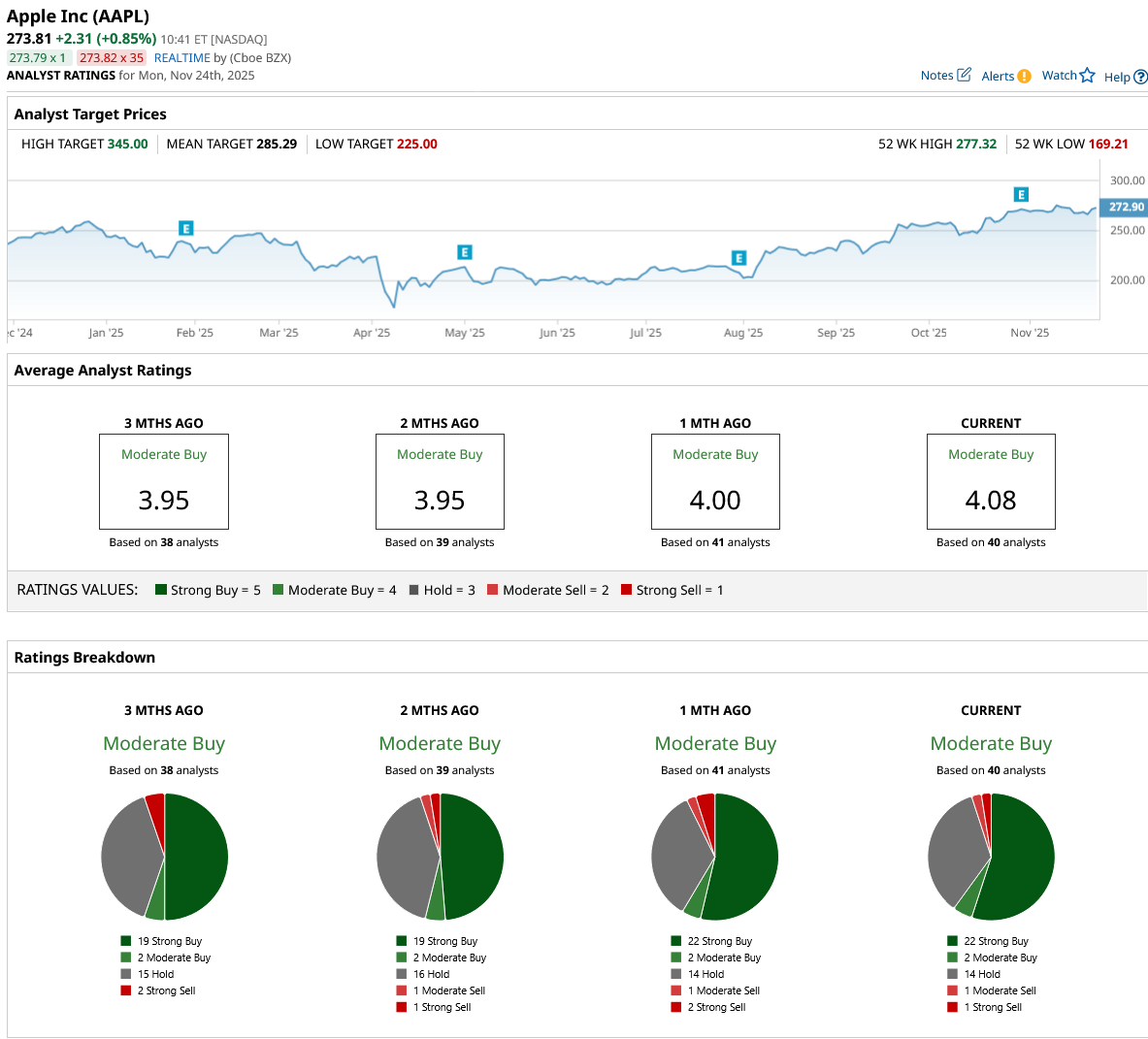

Most Wall Street analysts remain bullish on AAPL stock, as reflected in a consensus rating of “Moderate Buy.” Among the 40 analysts covering the stock, 22 rate it a “Strong Buy,” two a “Moderate Buy,” 14 recommend holding, one assigns a “Moderate Sell” rating, and one gives it a “Strong Sell” rating. The mean price target for AAPL stock is $285.29, which is 5% above Friday’s closing price.

Putting it all together, I don’t believe investors should follow Mr. Buffett’s lead and sell AAPL stock. First, as noted earlier, his move appears to be a pure value play, and Apple remains Berkshire’s largest holding. Second, AAPL stock has the potential to serve as a safe haven if the AI bubble deflates. Third, early numbers indicate that sales in China are performing well, which should bode well for its FQ1 results and will likely be reflected positively in the stock price.

On the date of publication, Oleksandr Pylypenko had a position in: GOOGL , NVDA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 3 Under-the-Radar Tech Stocks to Buy as Nvidia Proves the AI Trade Has Staying Power

- Bridgewater Associates Just Bought QuantumScape Stock. Should You?

- Palo Alto Networks' Stock Has Tanked But Its FCF is Strong - Price Target is 15% Higher

- Should You Buy the 17% Pullback in Alibaba Stock Before November 25?