Assured Guaranty currently trades at $89.47 per share and has shown little upside over the past six months, posting a middling return of 4.8%. The stock also fell short of the S&P 500’s 10.4% gain during that period.

Is now the time to buy Assured Guaranty, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free for active Edge members.

Why Do We Think Assured Guaranty Will Underperform?

We don't have much confidence in Assured Guaranty. Here are three reasons there are better opportunities than AGO and a stock we'd rather own.

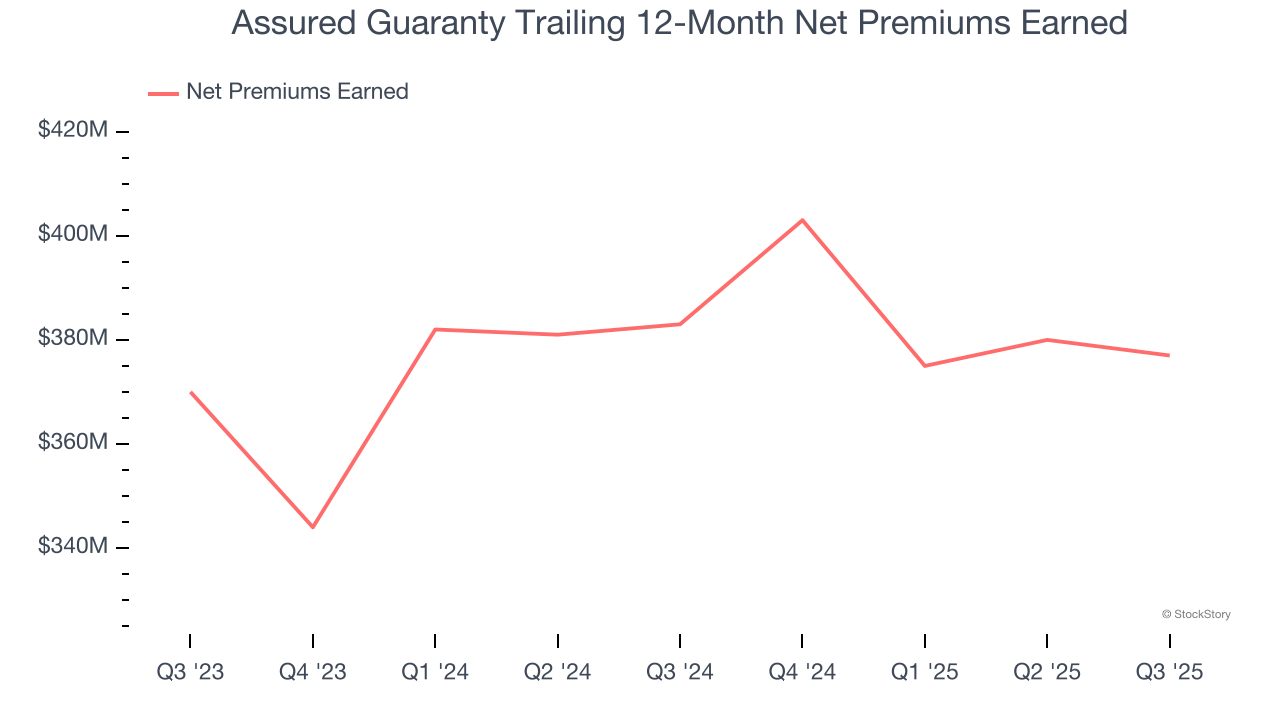

1. Declining Net Premiums Earned Reflect Weakness

When insurers sell policies, they protect themselves from extremely large losses or an outsized accumulation of losses with reinsurance (insurance for insurance companies). Net premiums earned are therefore gross premiums less what’s ceded to reinsurers as a risk mitigation and transfer strategy.

Assured Guaranty’s net premiums earned has declined by 3.6% annually over the last five years, much worse than the broader insurance industry. This shows that policy underwriting underperformed its other business lines.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Assured Guaranty’s revenue to drop by 20.2%, a decrease from its 14% annualized declines for the past two years. This projection is underwhelming and suggests its products and services will face some demand challenges.

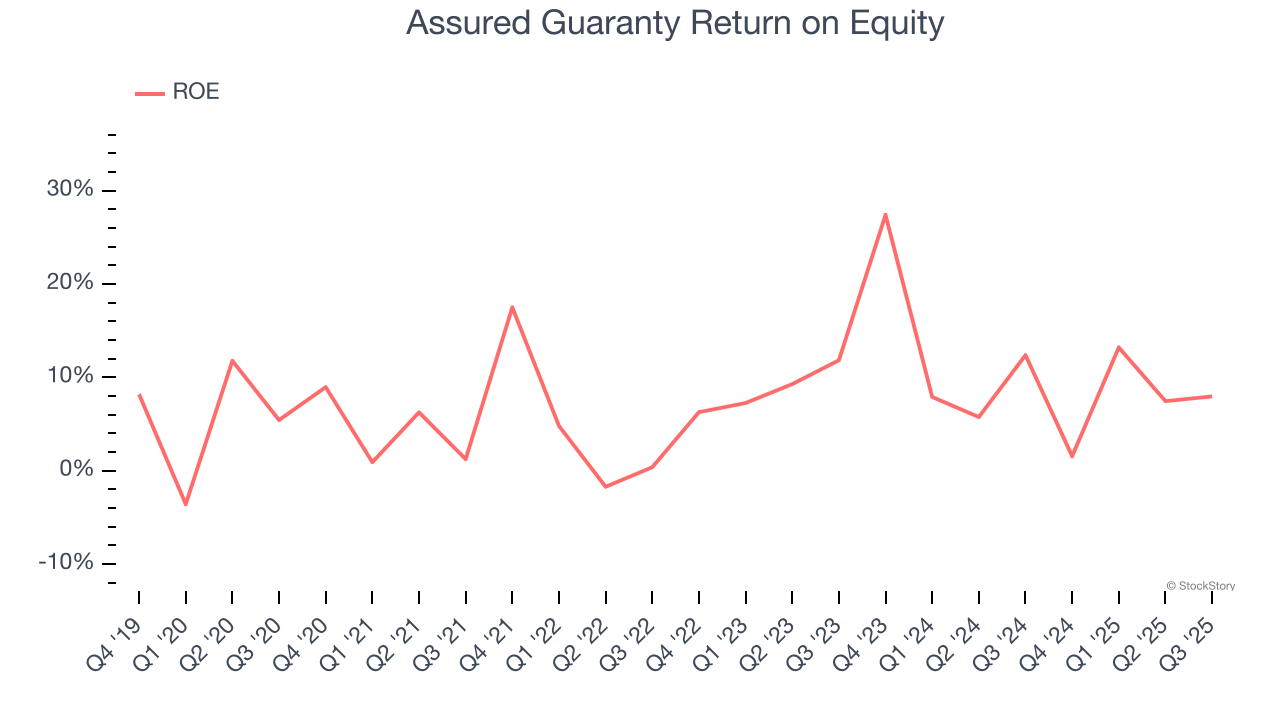

3. Previous Growth Initiatives Haven’t Impressed

Return on equity (ROE) is a crucial yardstick for insurance companies, measuring their ability to generate returns on the capital provided by shareholders. Insurers that consistently deliver superior ROE tend to create more value for their investors over time through strategic capital allocation and shareholder-friendly policies.

Over the last five years, Assured Guaranty has averaged an ROE of 7.8%, uninspiring for a company operating in a sector where the average shakes out around 12.5%.

Final Judgment

We see the value of companies helping consumers, but in the case of Assured Guaranty, we’re out. With its shares underperforming the market lately, the stock trades at 0.7× forward P/B (or $89.47 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are more exciting stocks to buy at the moment. We’d recommend looking at an all-weather company that owns household favorite Taco Bell.

High-Quality Stocks for All Market Conditions

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.