Visual content marketplace Getty Images (NYSE:GETY) reported Q4 CY2024 results beating Wall Street’s revenue expectations, with sales up 9.5% year on year to $247.3 million. On the other hand, the company’s full-year revenue guidance of $936.5 million at the midpoint came in 2.3% below analysts’ estimates. Its GAAP profit of $0.06 per share was $0.02 above analysts’ consensus estimates.

Is now the time to buy Getty Images? Find out by accessing our full research report, it’s free.

Getty Images (GETY) Q4 CY2024 Highlights:

- Revenue: $247.3 million vs analyst estimates of $246 million (9.5% year-on-year growth, 0.5% beat)

- EPS (GAAP): $0.06 vs analyst estimates of $0.04 ($0.02 beat)

- Adjusted EBITDA: $80.61 million vs analyst estimates of $74.74 million (32.6% margin, 7.9% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $936.5 million at the midpoint, missing analyst estimates by 2.3% and implying -0.3% growth (vs 2.6% in FY2024)

- EBITDA guidance for the upcoming financial year 2025 is $281 million at the midpoint, below analyst estimates of $302.6 million

- Operating Margin: 14.5%, down from 18.1% in the same quarter last year

- Market Capitalization: $838.6 million

“In 2024, we returned to full-year growth, driven by our premium content, industry-leading talent, and deep partnerships,” said Craig Peters, Chief Executive Officer at Getty Images.

Company Overview

With a vast library of over 562 million visual assets documenting everything from breaking news to iconic historical moments, Getty Images (NYSE:GETY) is a global visual content marketplace that licenses photos, videos, illustrations, and music to businesses, media outlets, and creative professionals.

Digital Media & Content Platforms

AI-driven content creation, personalized media experiences, and digital advertising are evolving, which could benefit companies investing in these themes. For example, companies with a portfolio of licensed visual content or platforms facilitating direct monetization models could see increased demand for years. On the other hand, headwinds include growing regulatory scrutiny on AI-generated content, with many publishers balking at anything that gets no human oversight. Additional areas to navigate include the phasing out of third-party cookies, which could make traditional ways of tracking the online behavior of consumers (a secret sauce in digital marketing) much less effective.

Sales Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $939.3 million in revenue over the past 12 months, Getty Images is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels.

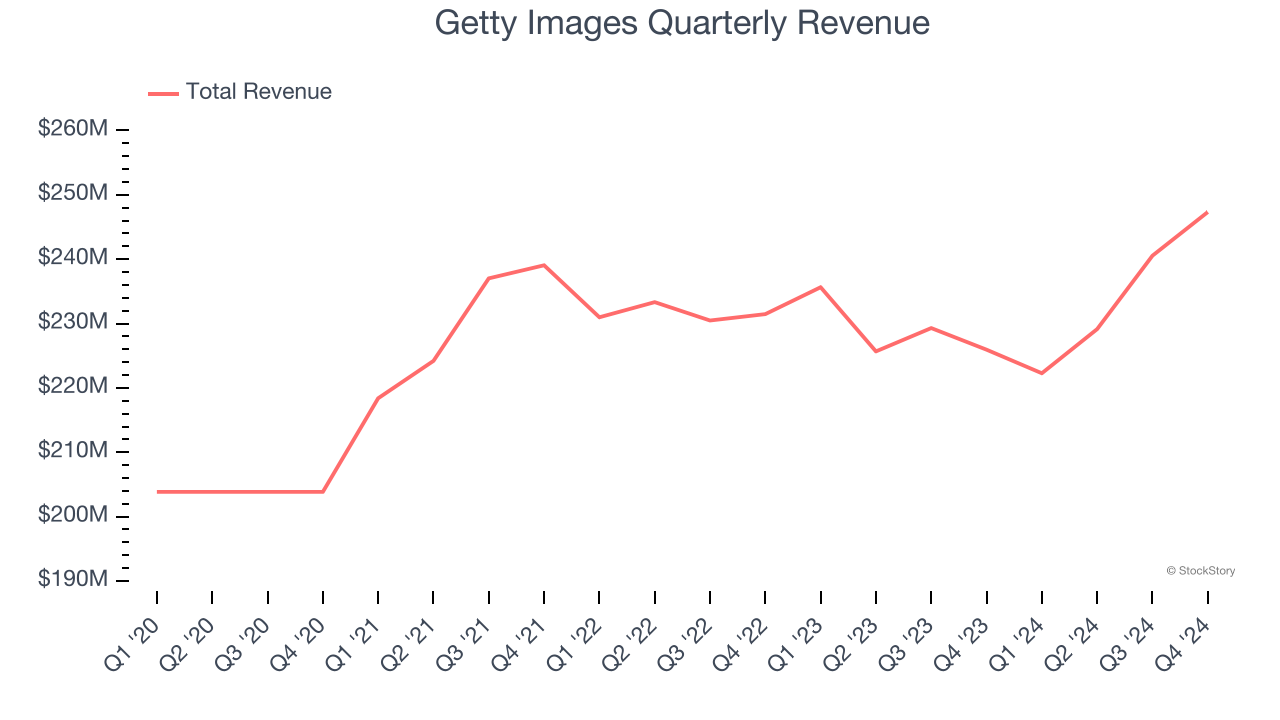

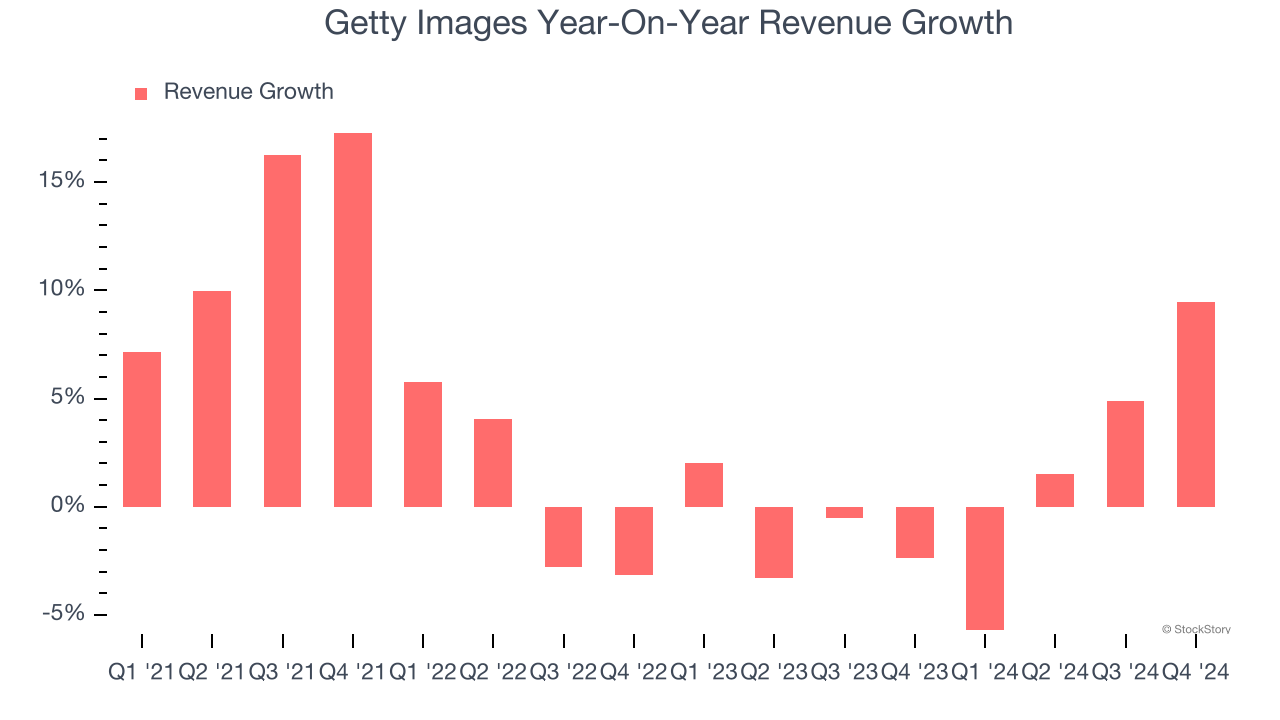

As you can see below, Getty Images grew its sales at a tepid 3.6% compounded annual growth rate over the last four years. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a stretched historical view may miss recent innovations or disruptive industry trends. Getty Images’s recent history shows its demand has slowed as its revenue was flat over the last two years.

This quarter, Getty Images reported year-on-year revenue growth of 9.5%, and its $247.3 million of revenue exceeded Wall Street’s estimates by 0.5%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. This projection is underwhelming and implies its newer products and services will not lead to better top-line performance yet.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

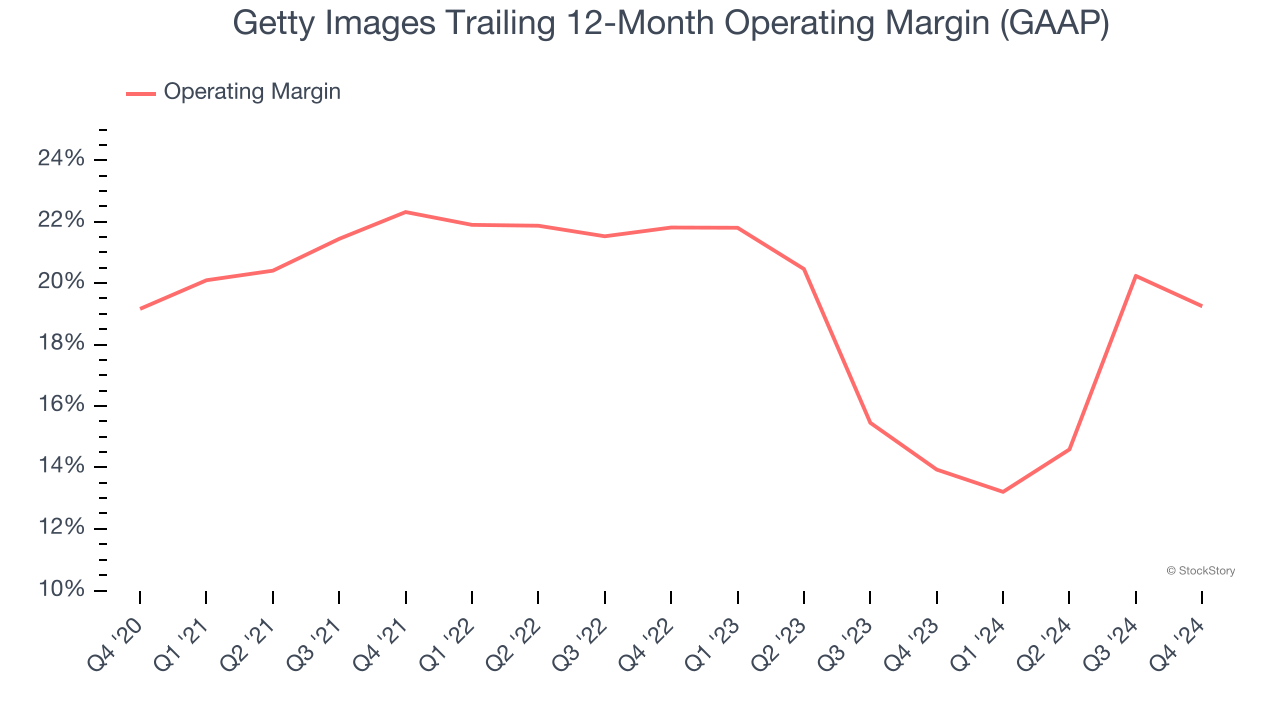

Getty Images has been a well-oiled machine over the last five years. It demonstrated elite profitability for a business services business, boasting an average operating margin of 19.3%.

Looking at the trend in its profitability, Getty Images’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Getty Images generated an operating profit margin of 14.5%, down 3.6 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

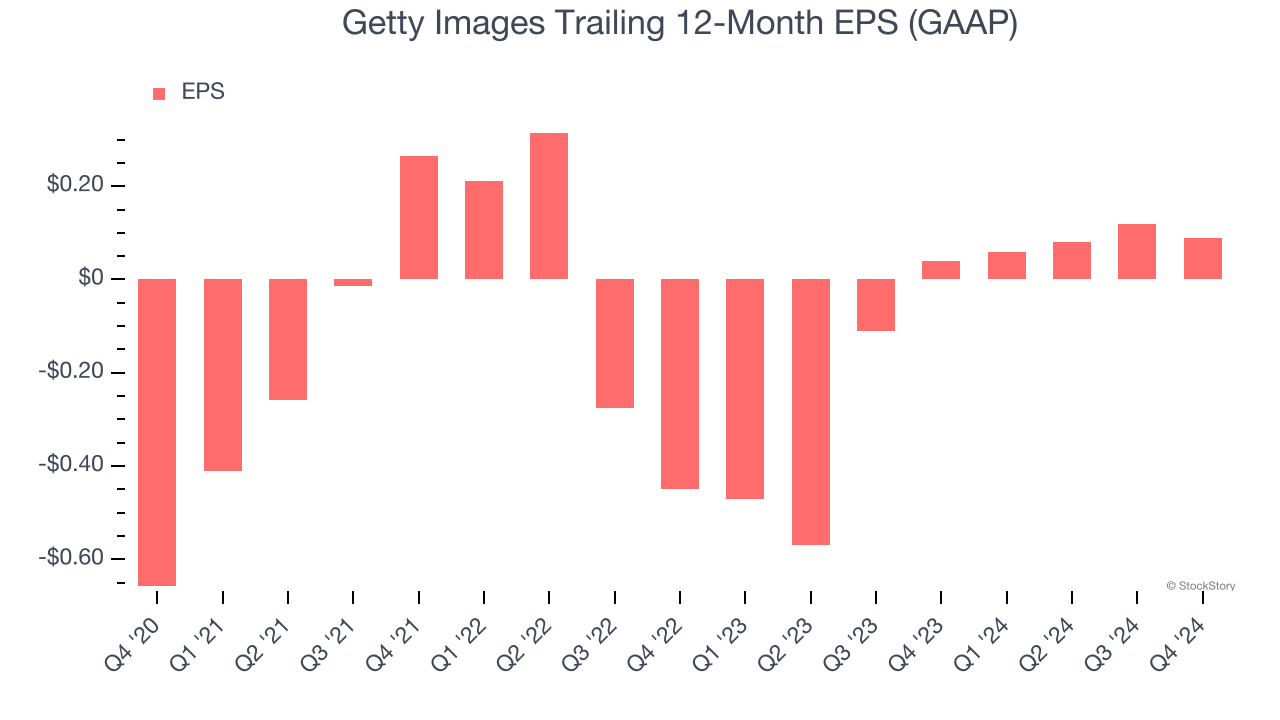

Getty Images’s full-year EPS flipped from negative to positive over the last four years. This is encouraging and shows it’s at a critical moment in its life.

In Q4, Getty Images reported EPS at $0.06, down from $0.09 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Getty Images to perform poorly. Analysts forecast its full-year EPS of $0.09 will hit $0.10.

Key Takeaways from Getty Images’s Q4 Results

We were impressed by how significantly Getty Images blew past analysts’ EPS and EBITDA expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. On the other hand, its full-year revenue and EBITDA guidance missed. Overall, this quarter was mixed. The stock remained flat at $2.15 immediately following the results.

So do we think Getty Images is an attractive buy at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.