EXL currently trades at $45.22 and has been a dream stock for shareholders. It’s returned 414% since March 2020, more than tripling the S&P 500’s 133% gain. The company has also beaten the index over the past six months as its stock price is up 23.3%.

Is it too late to buy EXLS? Find out in our full research report, it’s free.

Why Is EXL a Good Business?

Originally founded as an outsourcing company in 1999 before evolving into a technology-focused enterprise, EXL (NASDAQ:EXLS) provides data analytics and AI-powered digital operations solutions that help businesses transform their operations and make better decisions.

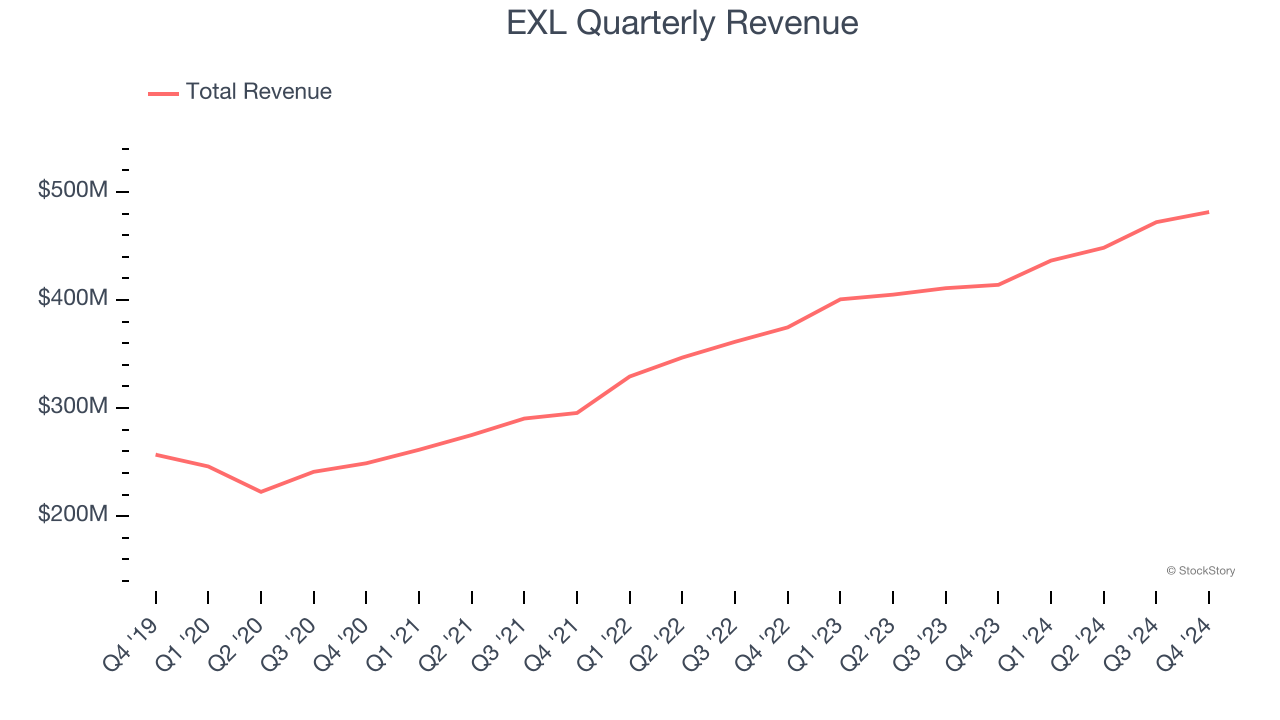

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, EXL grew its sales at an exceptional 13.1% compounded annual growth rate. Its growth surpassed the average business services company and shows its offerings resonate with customers.

2. Projected Revenue Growth Is Remarkable

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite, though some deceleration is natural as businesses become larger.

Over the next 12 months, sell-side analysts expect EXL’s revenue to rise by 11.9%. While this projection is slightly below its 14.1% annualized growth rate for the past two years, it is admirable and suggests the market sees success for its products and services.

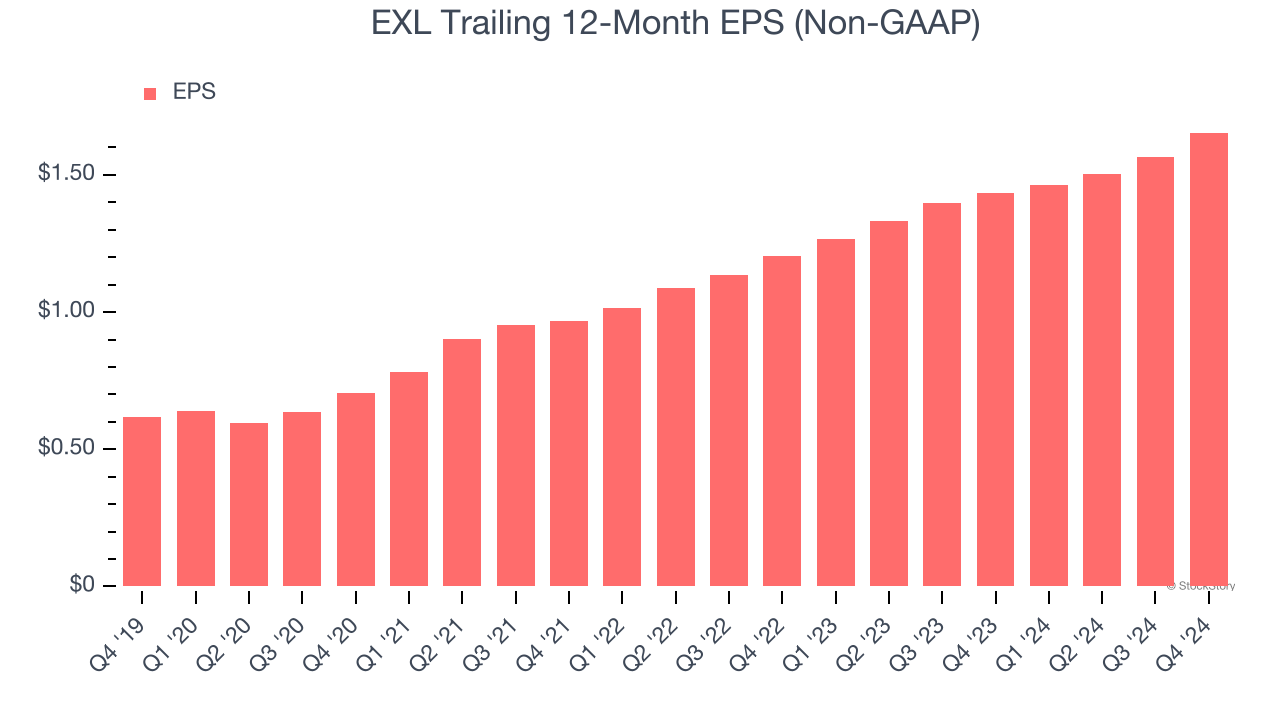

3. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

EXL’s EPS grew at an astounding 21.8% compounded annual growth rate over the last five years, higher than its 13.1% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Final Judgment

These are just a few reasons why we think EXL is a high-quality business, and with its shares outperforming the market lately, the stock trades at 24.9× forward price-to-earnings (or $45.22 per share). Is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than EXL

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.