Electronics manufacturing services provider Jabil (NYSE:JBL) beat Wall Street’s revenue expectations in Q1 CY2025, but sales were flat year on year at $6.73 billion. On top of that, next quarter’s revenue guidance ($7 billion at the midpoint) was surprisingly good and 4% above what analysts were expecting. Its non-GAAP profit of $1.94 per share was 6.2% above analysts’ consensus estimates.

Is now the time to buy Jabil? Find out by accessing our full research report, it’s free.

Jabil (JBL) Q1 CY2025 Highlights:

- Revenue: $6.73 billion vs analyst estimates of $6.40 billion (flat year on year, 5.1% beat)

- Adjusted EPS: $1.94 vs analyst estimates of $1.83 (6.2% beat)

- The company lifted its revenue guidance for the full year to $27.9 billion at the midpoint from $27.3 billion, a 2.2% increase

- Management raised its full-year Adjusted EPS guidance to $8.95 at the midpoint, a 2.3% increase

- Operating Margin: 3.6%, down from 16.7% in the same quarter last year

- Free Cash Flow Margin: 3.9%, up from 0.7% in the same quarter last year

- Market Capitalization: $15.28 billion

“I am very pleased with our strong year-to-date results, which underscore the resilience and strength of our diversified portfolio. In Q2, we exceeded our expectations due to continued strength in our capital equipment, cloud and data center infrastructure, and digital commerce end-markets,” said CEO Mike Dastoor.

Company Overview

With manufacturing facilities spanning the globe from China to Mexico to the United States, Jabil (NYSE:JBL) provides electronics design, manufacturing, and supply chain solutions to companies across various industries, from healthcare to automotive to cloud computing.

Electronic Components & Manufacturing

The sector could see higher demand as the prevalence of advanced electronics increases in industries such as automotive, healthcare, aerospace, and computing. The high-performance components and contract manufacturing expertise required for autonomous vehicles and cloud computing datacenters, for instance, will benefit companies in the space. However, headwinds include geopolitical risks, particularly U.S.-China trade tensions that could disrupt component sourcing and production as the Trump administration takes an increasingly antagonizing stance on foreign relations. Additionally, stringent environmental regulations on e-waste and emissions could force the industry to pivot in potentially costly ways.

Sales Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $27.45 billion in revenue over the past 12 months, Jabil is a behemoth in the business services sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices. However, its scale is a double-edged sword because it’s harder to find incremental growth when you’ve penetrated most of the market. To accelerate sales, Jabil likely needs to optimize its pricing or lean into new offerings and international expansion.

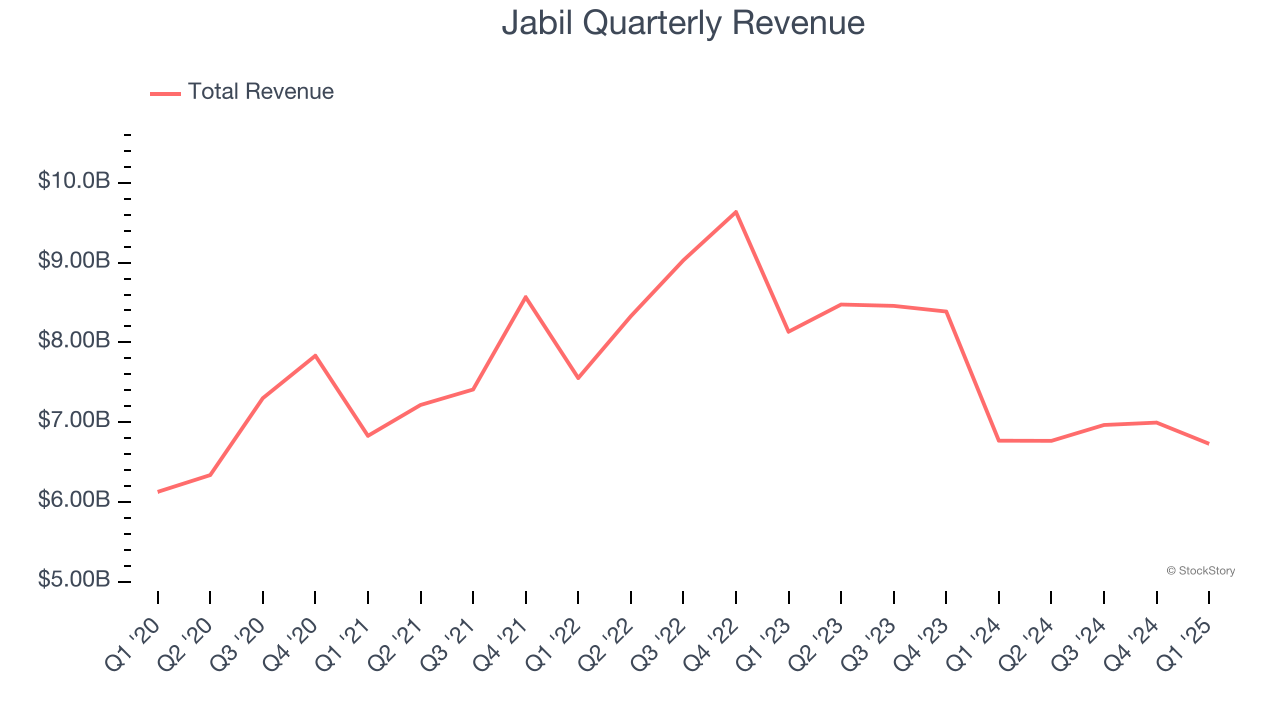

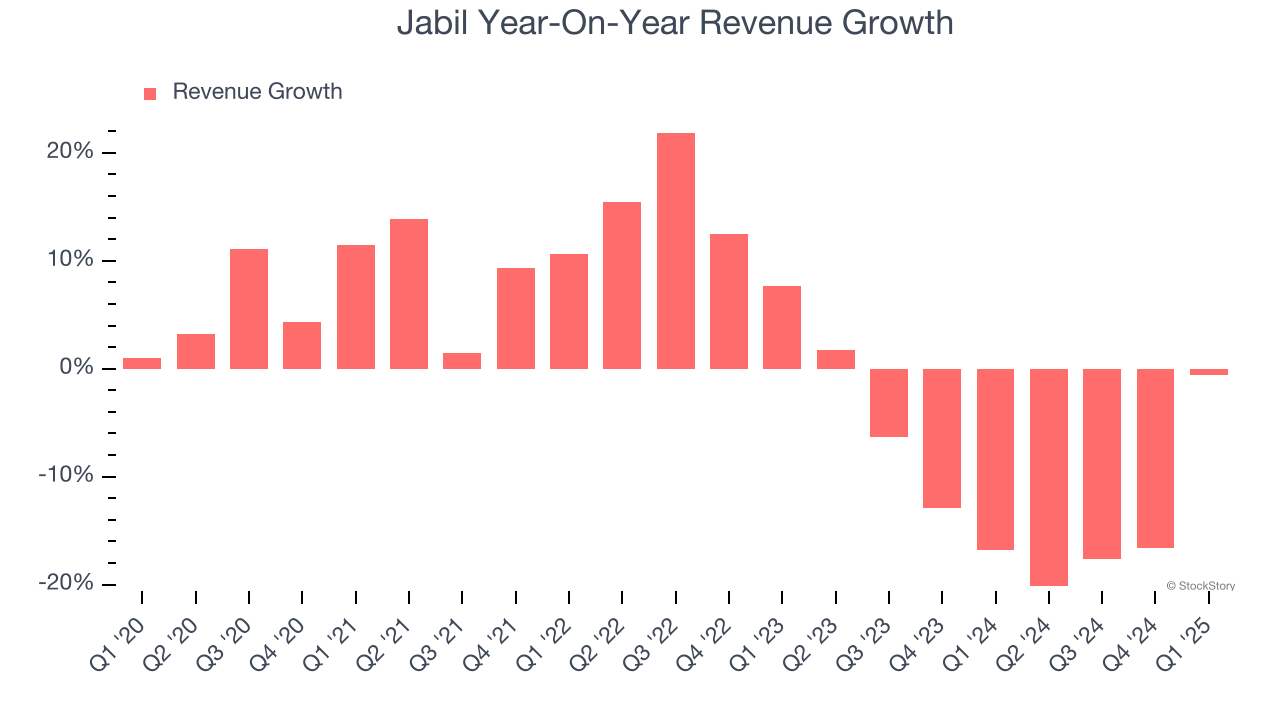

As you can see below, Jabil struggled to increase demand as its $27.45 billion of sales for the trailing 12 months was close to its revenue five years ago. This shows demand was soft, a rough starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Jabil’s recent history shows its demand remained suppressed as its revenue has declined by 11.6% annually over the last two years.

This quarter, Jabil’s $6.73 billion of revenue was flat year on year but beat Wall Street’s estimates by 5.1%. Company management is currently guiding for a 3.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 1.8% over the next 12 months. Although this projection suggests its newer products and services will spur better top-line performance, it is still below average for the sector.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

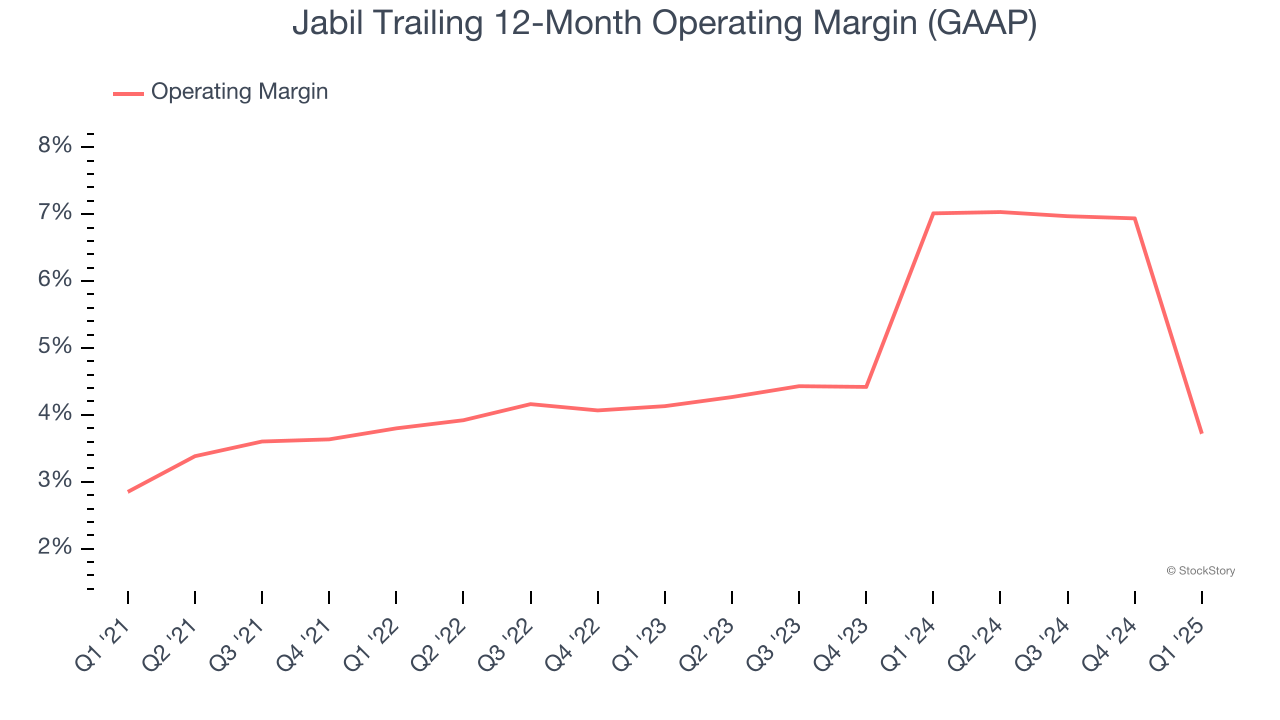

Jabil was profitable over the last five years but held back by its large cost base. Its average operating margin of 4.4% was weak for a business services business.

Analyzing the trend in its profitability, Jabil’s operating margin might fluctuated slightly but has generally stayed the same over the last five years, which doesn’t help its cause.

This quarter, Jabil generated an operating profit margin of 3.6%, down 13.1 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

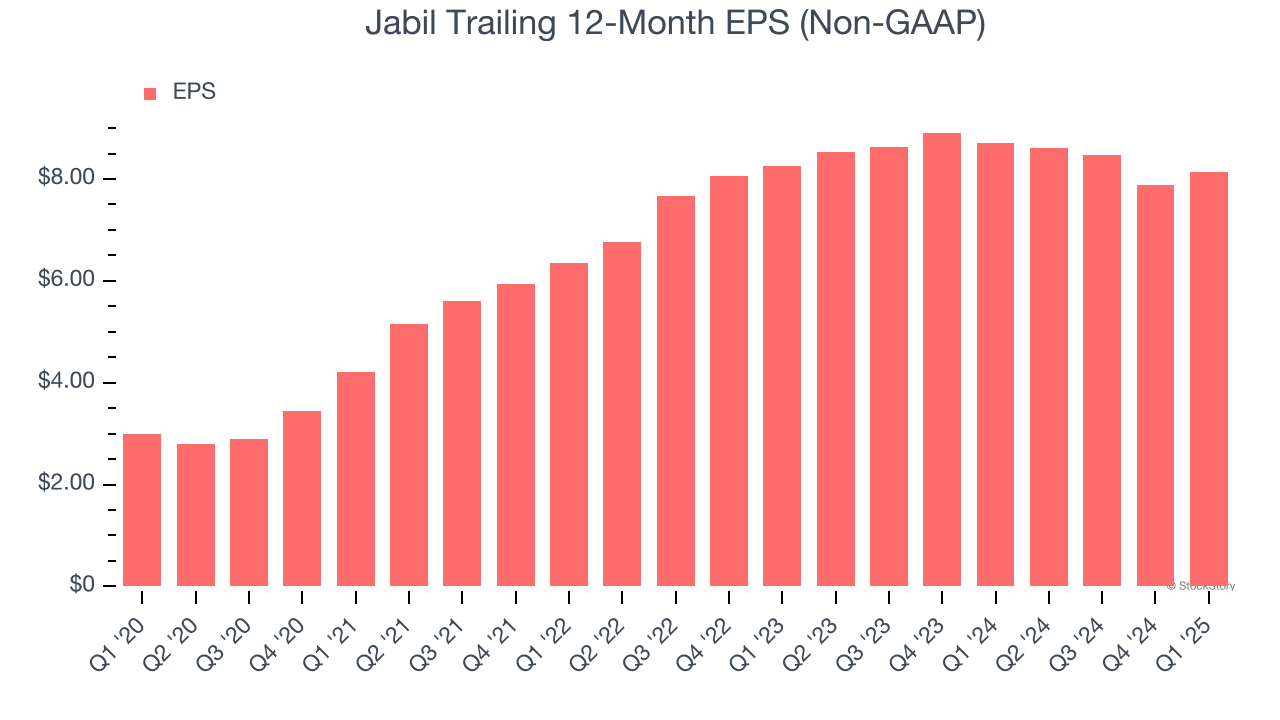

Jabil’s EPS grew at an astounding 22.2% compounded annual growth rate over the last five years, higher than its flat revenue. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t expand.

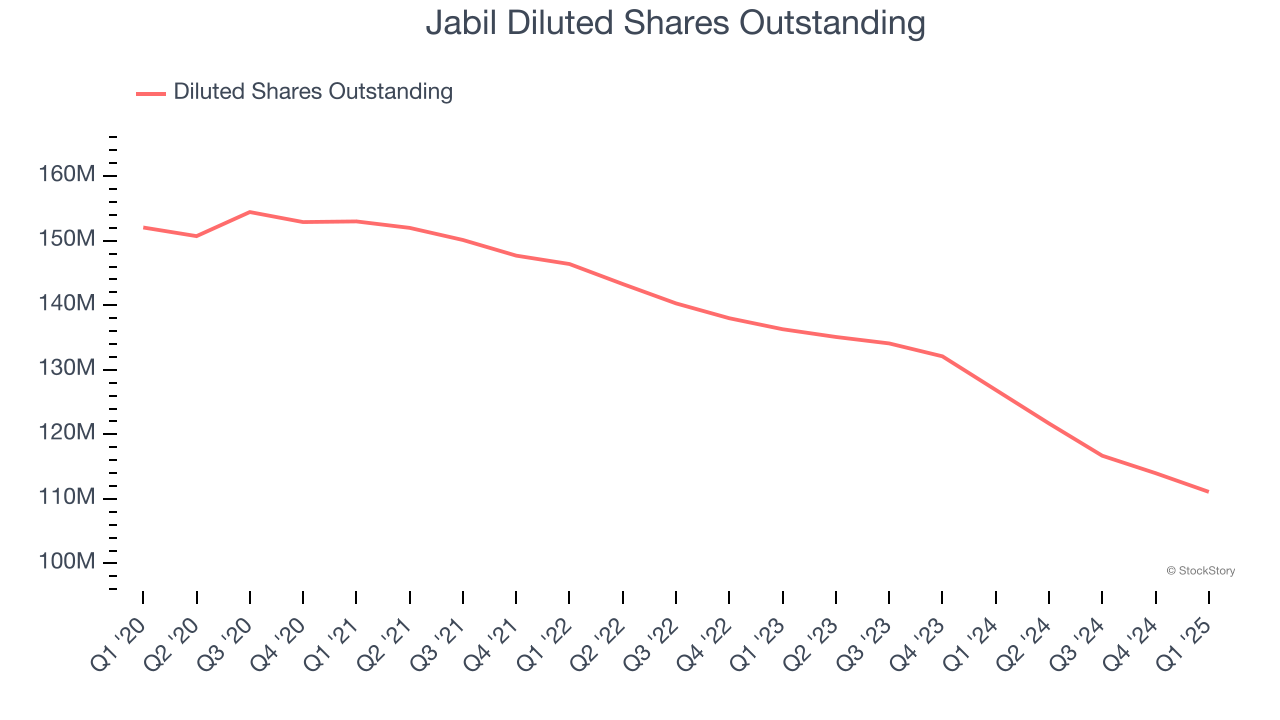

We can take a deeper look into Jabil’s earnings to better understand the drivers of its performance. A five-year view shows that Jabil has repurchased its stock, shrinking its share count by 26.9%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q1, Jabil reported EPS at $1.94, up from $1.68 in the same quarter last year. This print beat analysts’ estimates by 6.2%. Over the next 12 months, Wall Street expects Jabil’s full-year EPS of $8.14 to grow 17.4%.

Key Takeaways from Jabil’s Q1 Results

We were impressed by how significantly Jabil blew past analysts’ revenue expectations this quarter. We were also glad its revenue guidance for next quarter trumped Wall Street’s estimates. Zooming out, we think this was a good quarter with some key areas of upside. The stock traded up 6.5% to $148.50 immediately after reporting.

Sure, Jabil had a solid quarter, but if we look at the bigger picture, is this stock a buy? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.