Although the S&P 500 is down 1.4% over the past six months, Snap’s stock price has fallen further to $9.13, losing shareholders 14.7% of their capital. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Snap, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Even though the stock has become cheaper, we don't have much confidence in Snap. Here are three reasons why SNAP doesn't excite us and a stock we'd rather own.

Why Is Snap Not Exciting?

Founded by Stanford University students Evan Spiegel, Reggie Brown, and Bobby Murphy, and originally called Picaboo, Snapchat (NYSE: SNAP) is an image centric social media network.

1. Customer Spending Decreases, Engagement Falling?

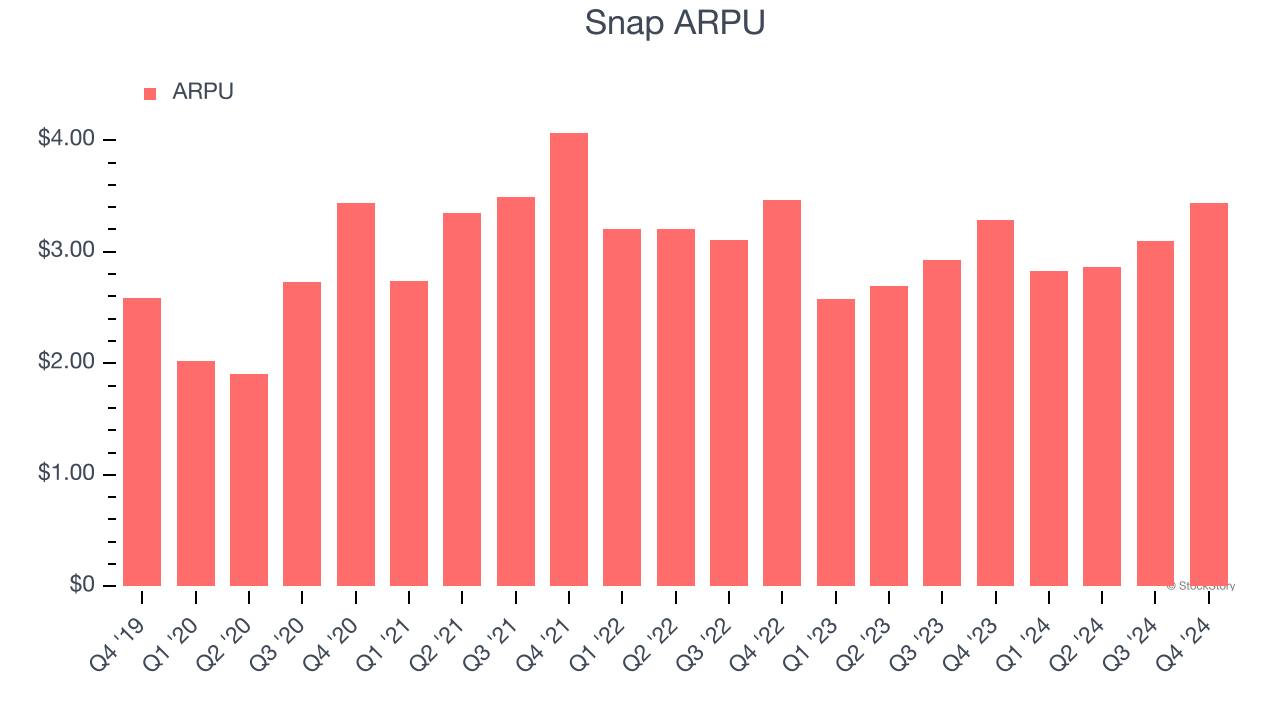

Average revenue per user (ARPU) is a critical metric to track because it measures how much the company earns from the ads shown to its users. ARPU can also be a proxy for how valuable advertisers find Snap’s audience and its ad-targeting capabilities.

Snap’s ARPU fell over the last two years, averaging 2.5% annual declines. This isn’t great, but the increase in daily active users is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Snap tries boosting ARPU by taking a more aggressive approach to monetization, it’s unclear whether users can continue growing at the current pace.

2. Shrinking EBITDA Margin

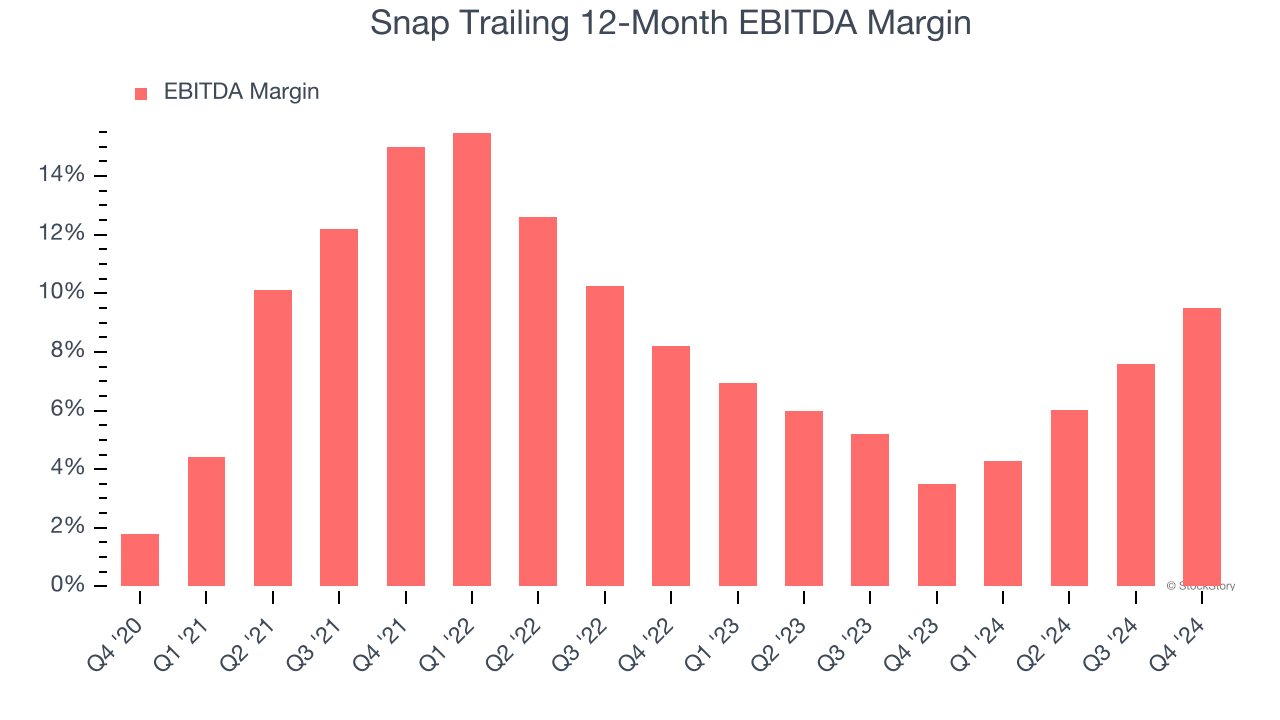

Operating income is often evaluated to assess a company’s underlying profitability. In a similar vein, EBITDA is used to analyze consumer internet companies because it excludes various one-time or non-cash expenses (depreciation), providing a clearer view of the business’s profit potential.

Looking at the trend in its profitability, Snap’s EBITDA margin decreased by 5.5 percentage points over the last few years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its EBITDA margin for the trailing 12 months was 9.5%.

3. EPS Trending Down

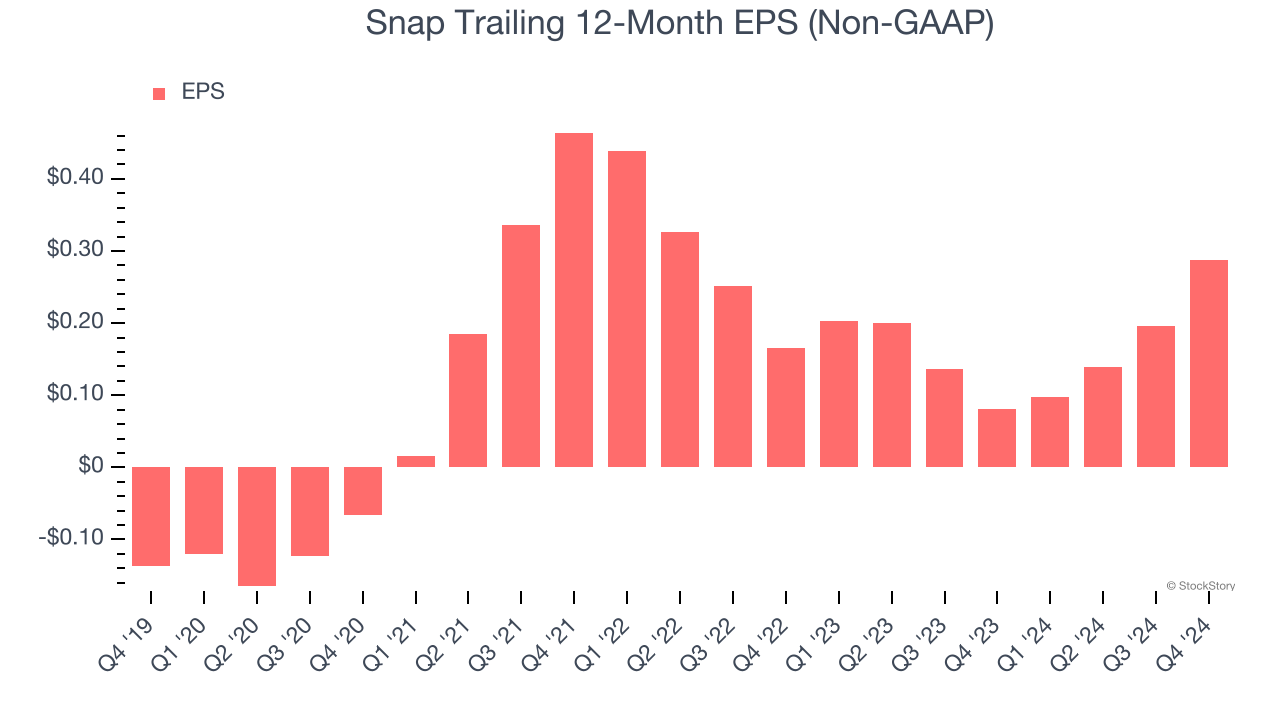

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Snap, its EPS declined by 14.7% annually over the last three years while its revenue grew by 9.2%. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

Snap’s business quality ultimately falls short of our standards. After the recent drawdown, the stock trades at 21.2× forward EV-to-EBITDA (or $9.13 per share). This valuation tells us a lot of optimism is priced in - we think there are better stocks to buy right now. Let us point you toward an all-weather company that owns household favorite Taco Bell.

Stocks We Would Buy Instead of Snap

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.