Amphenol currently trades at $67.40 per share and has shown little upside over the past six months, posting a middling return of 3.4%.

Given the underwhelming price action, is now a good time to buy APH? Or should investors expect a bumpy road ahead? Find out in our full research report, it’s free.

Why Is Amphenol a Good Business?

With over 90 years of connecting the world's technologies, Amphenol (NYSE:APH) designs and manufactures connectors, cables, sensors, and interconnect systems that enable electrical and electronic connections across virtually every industry.

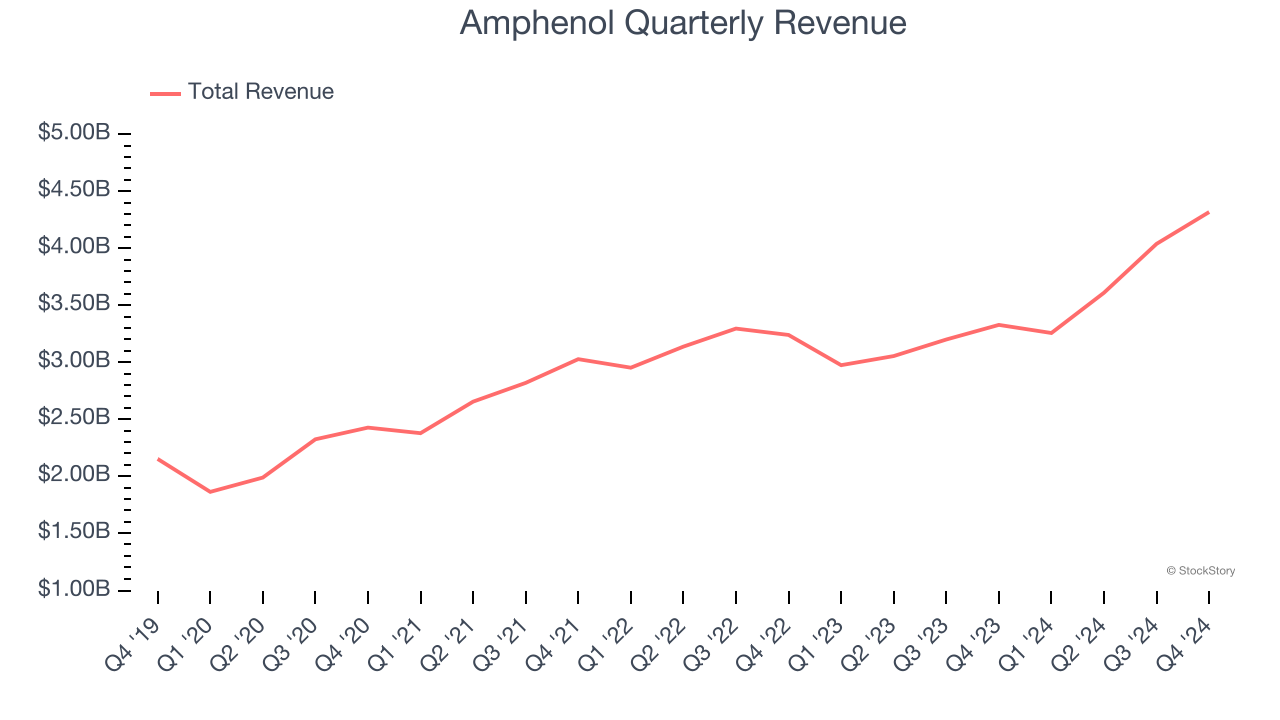

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Amphenol grew its sales at an exceptional 13.1% compounded annual growth rate. Its growth beat the average business services company and shows its offerings resonate with customers.

2. Economies of Scale Give It Negotiating Leverage with Suppliers

With $15.22 billion in revenue over the past 12 months, Amphenol is a behemoth in the business services sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices.

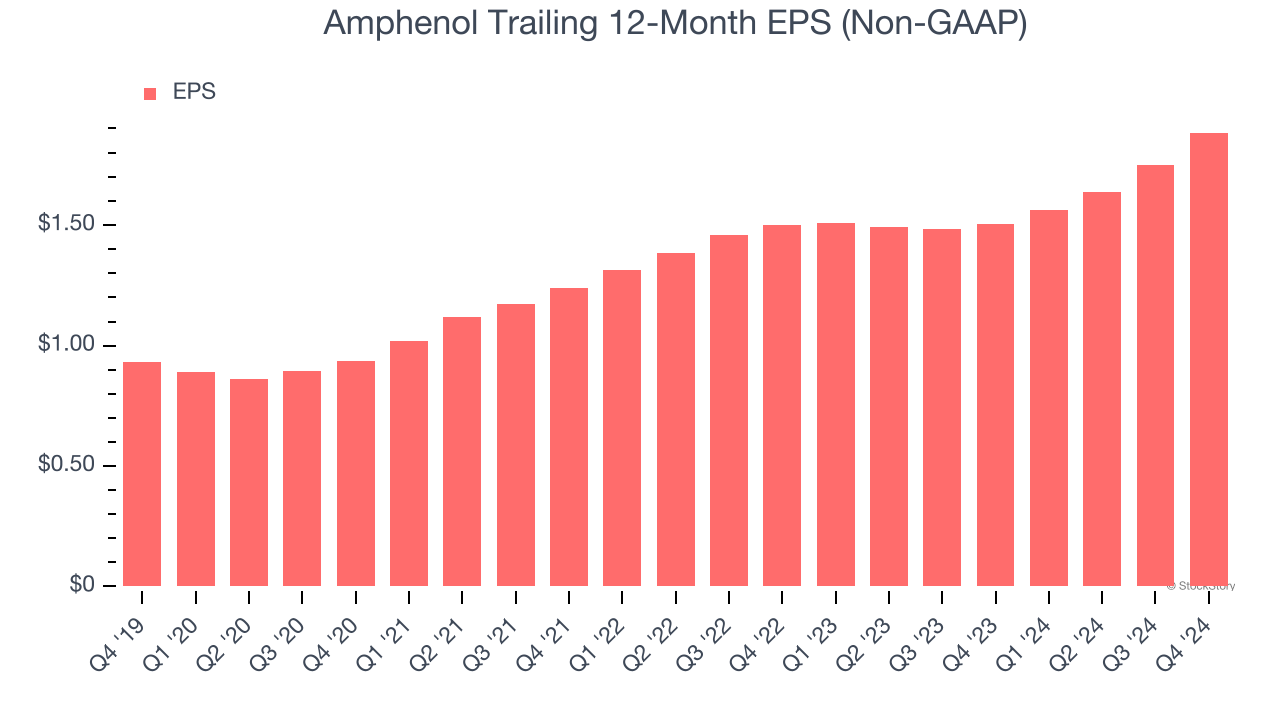

3. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Amphenol’s EPS grew at an astounding 15.1% compounded annual growth rate over the last five years, higher than its 13.1% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Final Judgment

These are just a few reasons why Amphenol ranks near the top of our list, but at $67.40 per share (or 31.1× forward price-to-earnings), is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Amphenol

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.