Looking back on leisure products stocks’ Q4 earnings, we examine this quarter’s best and worst performers, including American Outdoor Brands (NASDAQ:AOUT) and its peers.

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

The 13 leisure products stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.7% while next quarter’s revenue guidance was 1.9% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 10.9% since the latest earnings results.

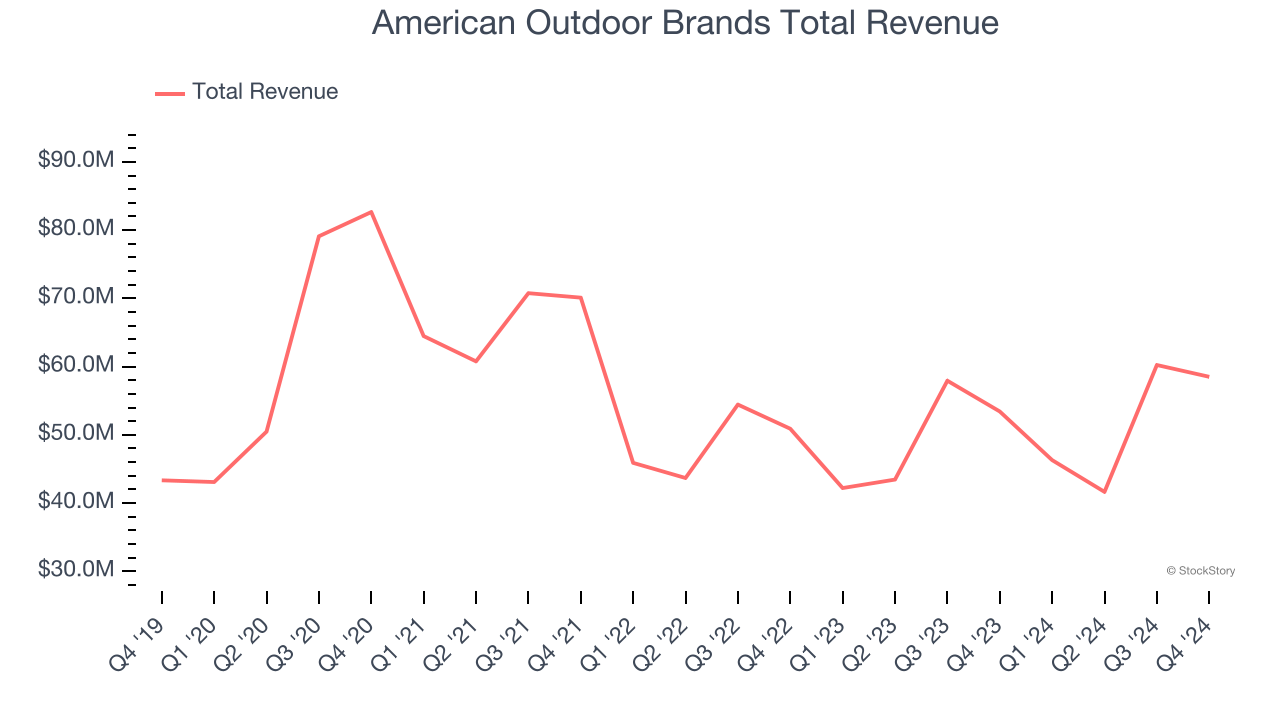

American Outdoor Brands (NASDAQ:AOUT)

Spun off from Smith and Wesson in 2020, American Outdoor Brands (NASDAQ:AOUT) is an outdoor and recreational products company that offers outdoor and shooting sports products but does not sell firearms themselves.

American Outdoor Brands reported revenues of $58.51 million, up 9.5% year on year. This print exceeded analysts’ expectations by 4%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Brian Murphy, President and Chief Executive Officer, said, "Our third quarter results came in ahead of our expectations. We believe our strong performance demonstrates the effectiveness of our long-term strategy to leverage our innovation advantage to broaden our distribution opportunities, expand awareness of our brands, and strengthen our margins. We delivered growth in both our Outdoor Lifestyle and our Shooting Sports categories, supported by year-over-year increases in nearly all sales channels in the third quarter, including our traditional, e-commerce, and domestic sales channels. In addition, we delivered a significant increase in Non-GAAP Adjusted EBITDAS, which nearly doubled year-over-year.

The stock is down 23.5% since reporting and currently trades at $11.50.

Is now the time to buy American Outdoor Brands? Access our full analysis of the earnings results here, it’s free.

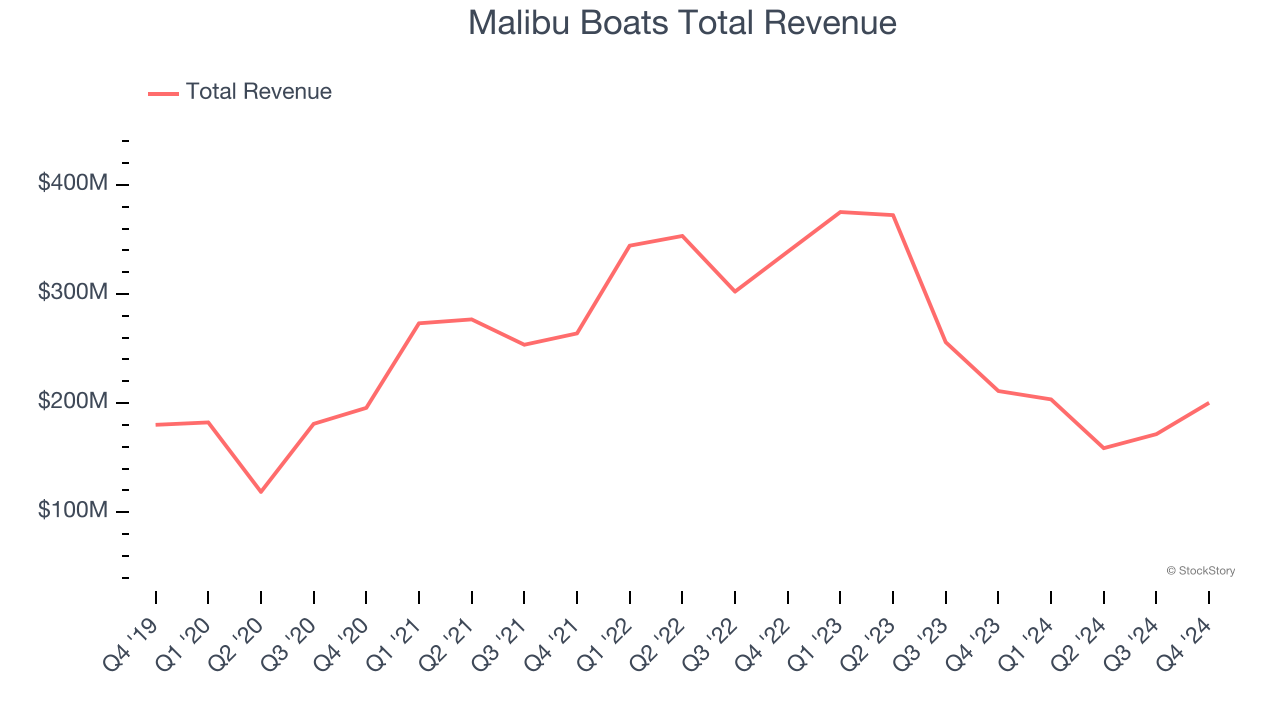

Best Q4: Malibu Boats (NASDAQ:MBUU)

Founded in California in 1982, Malibu Boats (NASDAQ:MBUU) is a manufacturer of high-performance sports boats and luxury watercrafts.

Malibu Boats reported revenues of $200.3 million, down 5.1% year on year, outperforming analysts’ expectations by 4.8%. The business had an exceptional quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ adjusted operating income estimates.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 19.4% since reporting. It currently trades at $30.94.

Is now the time to buy Malibu Boats? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Harley-Davidson (NYSE:HOG)

Founded in 1903, Harley-Davidson (NYSE:HOG) is an American motorcycle manufacturer known for its heavyweight motorcycles designed for cruising on highways.

Harley-Davidson reported revenues of $687.6 million, down 34.7% year on year, falling short of analysts’ expectations by 3.8%. It was a disappointing quarter as it posted a miss of analysts’ motorcycles sold and adjusted operating income estimates.

Harley-Davidson delivered the slowest revenue growth in the group. As expected, the stock is down 3.1% since the results and currently trades at $26.

Read our full analysis of Harley-Davidson’s results here.

Ruger (NYSE:RGR)

Founded in 1949, Ruger (NYSE:RGR) is an American manufacturer of firearms for the commercial sporting market.

Ruger reported revenues of $145.8 million, up 11.6% year on year. This number topped analysts’ expectations by 5.8%. Taking a step back, it was a mixed quarter as it logged a significant miss of analysts’ EBITDA estimates.

Ruger scored the fastest revenue growth among its peers. The stock is up 13.2% since reporting and currently trades at $40.16.

Read our full, actionable report on Ruger here, it’s free.

Acushnet (NYSE:GOLF)

Producer of the acclaimed Titleist Pro V1 golf ball, Acushnet (NYSE:GOLF) is a design and manufacturing company specializing in performance-driven golf products.

Acushnet reported revenues of $445.2 million, up 7.8% year on year. This print lagged analysts' expectations by 2.1%. Taking a step back, it was still a strong quarter as it produced an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

The stock is up 3% since reporting and currently trades at $68.09.

Read our full, actionable report on Acushnet here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.