Radiation safety company Mirion (NYSE:MIR) announced better-than-expected revenue in Q1 CY2025, with sales up 4.9% year on year to $202 million. Its non-GAAP profit of $0.10 per share was 27.4% above analysts’ consensus estimates.

Is now the time to buy Mirion? Find out by accessing our full research report, it’s free.

Mirion (MIR) Q1 CY2025 Highlights:

- Revenue: $202 million vs analyst estimates of $200.7 million (4.9% year-on-year growth, 0.6% beat)

- Adjusted EPS: $0.10 vs analyst estimates of $0.08 (27.4% beat)

- Adjusted EBITDA: $46.7 million vs analyst estimates of $44.4 million (23.1% margin, 5.2% beat)

- Management reiterated its full-year Adjusted EPS guidance of $0.48 at the midpoint

- EBITDA guidance for the full year is $222.5 million at the midpoint, in line with analyst expectations

- Operating Margin: 4.3%, up from -2.5% in the same quarter last year

- Free Cash Flow was $27.1 million, up from -$6.8 million in the same quarter last year

- Market Capitalization: $3.18 billion

“We delivered a strong start to the year, with year-over-year revenue growth and adjusted free cash flow generation,” commented Mirion’s Chairman and Chief Executive Officer Thomas Logan.

Company Overview

With its technology protecting workers in over 130 countries and equipment used in 80% of cancer centers worldwide, Mirion Technologies (NYSE:MIR) provides radiation detection, measurement, and monitoring solutions for medical, nuclear energy, defense, and scientific research applications.

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $870.2 million in revenue over the past 12 months, Mirion is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

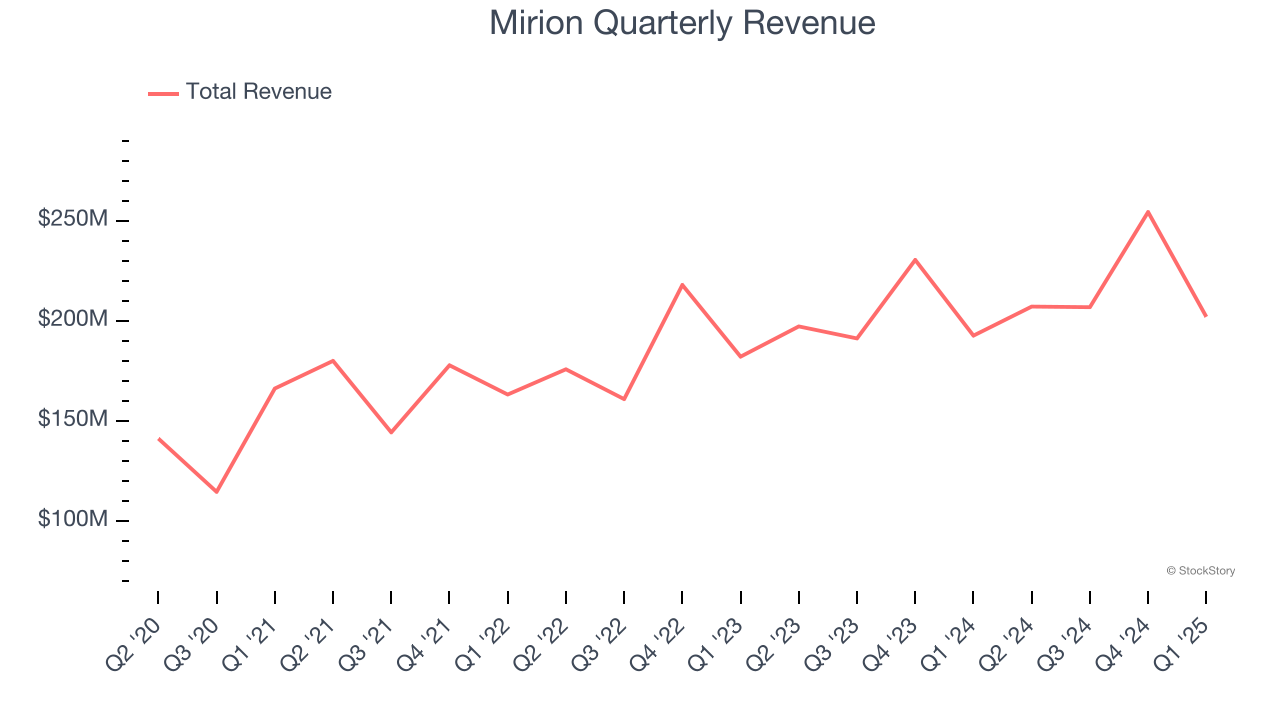

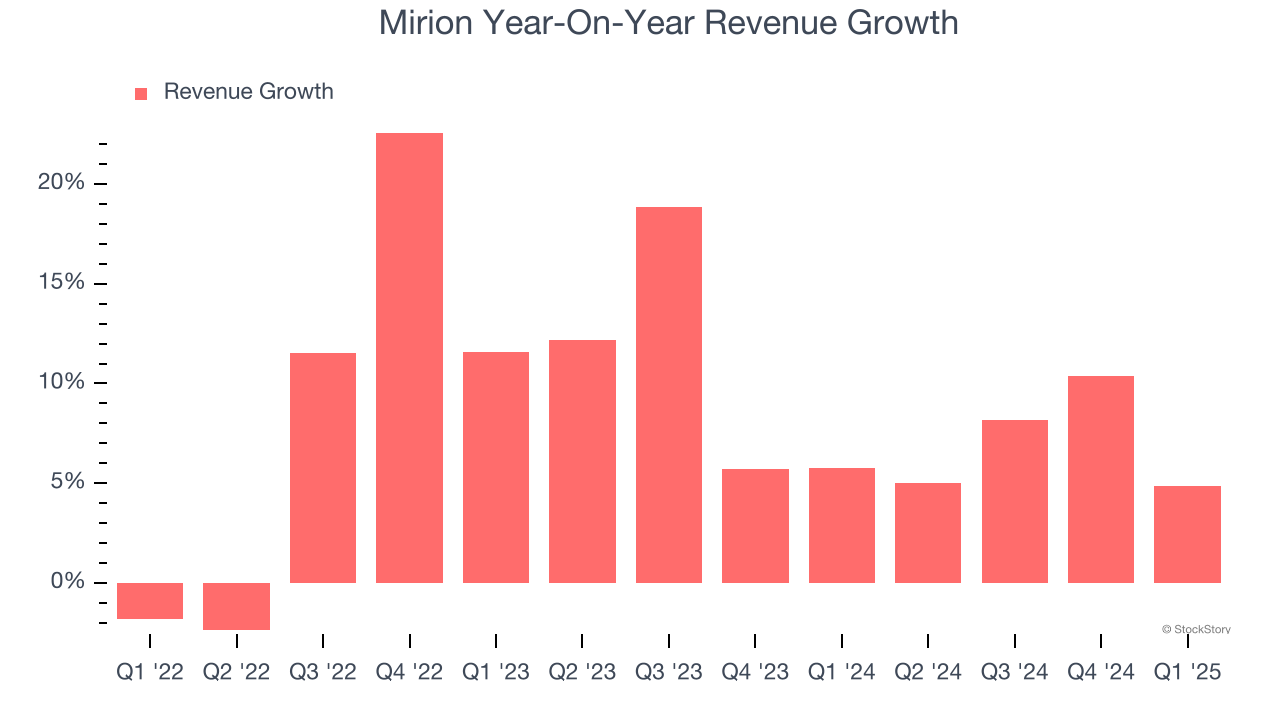

As you can see below, Mirion’s 9.4% annualized revenue growth over the last three years was impressive. This shows it had high demand, a useful starting point for our analysis.

Long-term growth is the most important, but within business services, a stretched historical view may miss new innovations or demand cycles. Mirion’s annualized revenue growth of 8.7% over the last two years aligns with its three-year trend, suggesting its demand was predictably strong.

This quarter, Mirion reported modest year-on-year revenue growth of 4.9% but beat Wall Street’s estimates by 0.6%.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

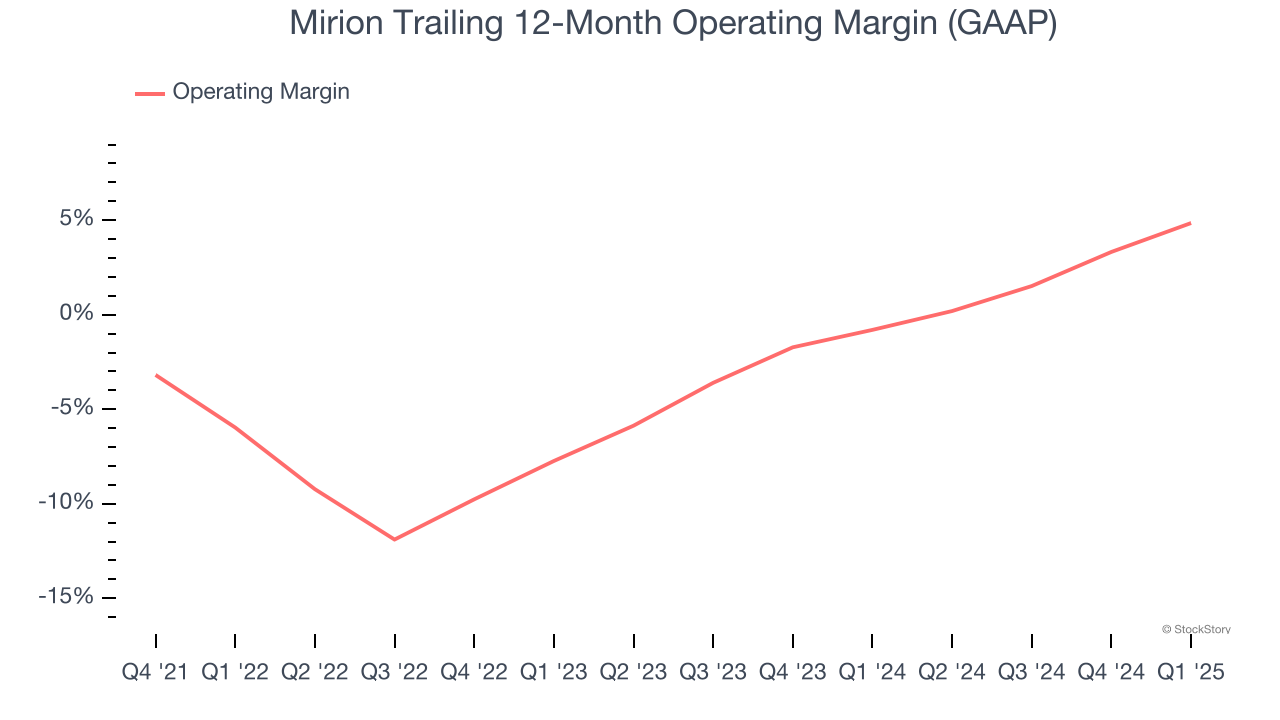

Although Mirion was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 1.3% over the last five years. Unprofitable business services companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Analyzing the trend in its profitability, Mirion’s operating margin decreased by 1.5 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Mirion’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, Mirion generated an operating profit margin of 4.3%, up 6.9 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

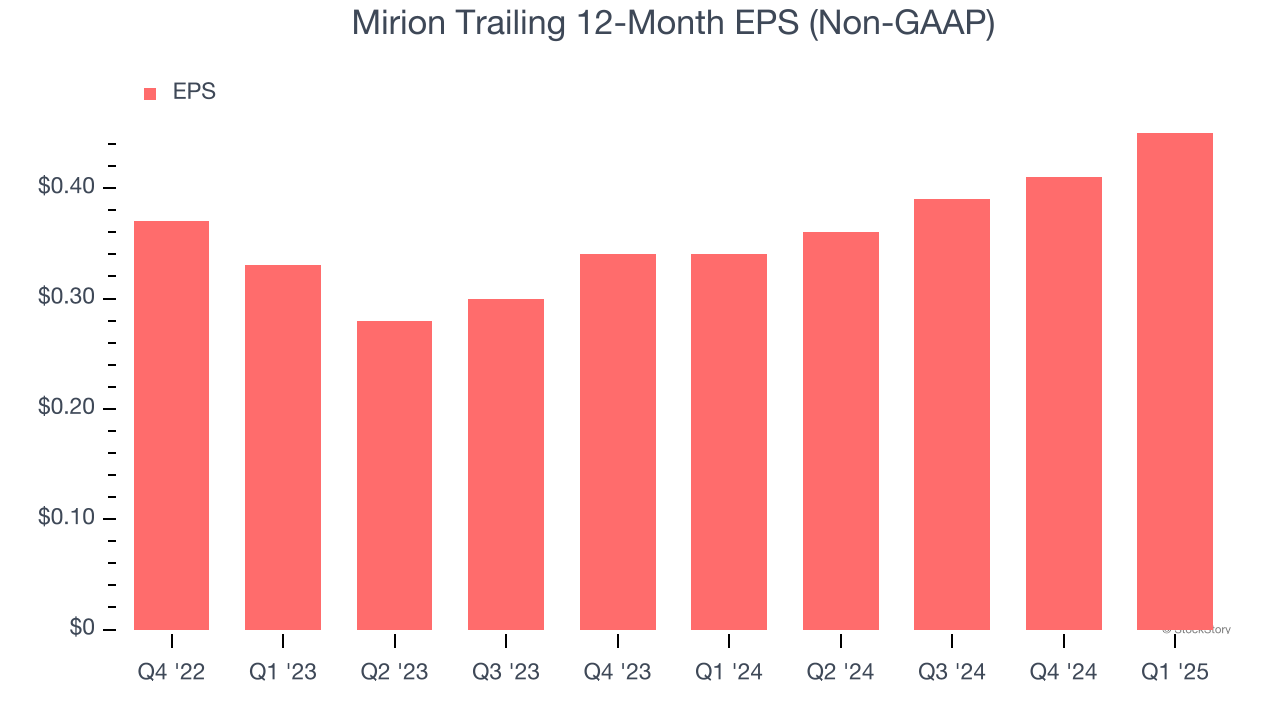

Mirion’s full-year EPS grew at an astounding 16.8% compounded annual growth rate over the last two years, better than the broader business services sector.

In Q1, Mirion reported EPS at $0.10, up from $0.06 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data. This signals Mirion could be a hidden gem because it doesn’t have much coverage among professional brokers.

Key Takeaways from Mirion’s Q1 Results

We were impressed by how Mirion beat analysts’ revenue, EPS, and EBITDA expectations this quarter. We were also glad its full-year EPS guidance outperformed Wall Street’s estimates. Zooming out, we think this was a solid quarter. The stock traded up 2.8% to $16 immediately following the results.

Mirion had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.