Articles from OptionMetrics

OptionMetrics, a historical options database and analytics provider for institutional investors and academic researchers worldwide, announces availability of IvyDB US – Intraday. This new dataset capitalizes on the “gold standard” in US options data that OptionMetrics has become known for, while now also including daily snapshots – at 10:00 a.m., 2:00 p.m., and 3:45 p.m. Eastern Time – of options prices and volatility calculations on US exchange-traded equity and index options. IvyDB US – Intraday captures 0DTE (zero days to expiration) options quotes and volatilities with snapshots of underlying prices, zero curves, dividend yields, and borrow rates daily on equities, with historical data beginning in 2018.

By OptionMetrics · Via Business Wire · August 19, 2025

OptionMetrics, the leading historical options data and analytics provider for institutional investors and academic researchers worldwide, will be exhibiting at Commodity Trading Week Americas, Stamford, June 17-18.

By OptionMetrics · Via Business Wire · June 17, 2025

OptionMetrics, the leading historical options data and analytics provider for institutional investors and academic researchers worldwide, is exhibiting at Quant Strats on March 11 at Quorum by Convene in New York City.

By OptionMetrics · Via Business Wire · March 7, 2025

OptionMetrics, the leading options database and analytics provider for institutional investors and academic researchers worldwide, is exhibiting at Asset Management Derivatives Forum (AMDF) in Orlando, February 12-14, 2025.

By OptionMetrics · Via Business Wire · February 10, 2025

OptionMetrics, an options database and analytics provider for institutional investors and academic researchers worldwide, is exhibiting at BattleFin Discovery Day Miami, January 22-24. OptionMetrics Head Quant Garrett DeSimone will be speaking on Data Mosaic: Earnings on how alt data can refine earnings expectations, on January 23 at 10:30 a.m.

By OptionMetrics · Via Business Wire · January 21, 2025

OptionMetrics, an options database and analytics provider for institutional investors and academic researchers worldwide, and CRSP, Center for Research in Security Prices, have entered into a licensing agreement where OptionMetrics’ IvyDB US security IDs from its options data can be easily cross-referenced against the CRSP US Stock Database of PERMNO® numbers, or permanent stock (share class) level identifiers.

By OptionMetrics · Via Business Wire · January 9, 2025

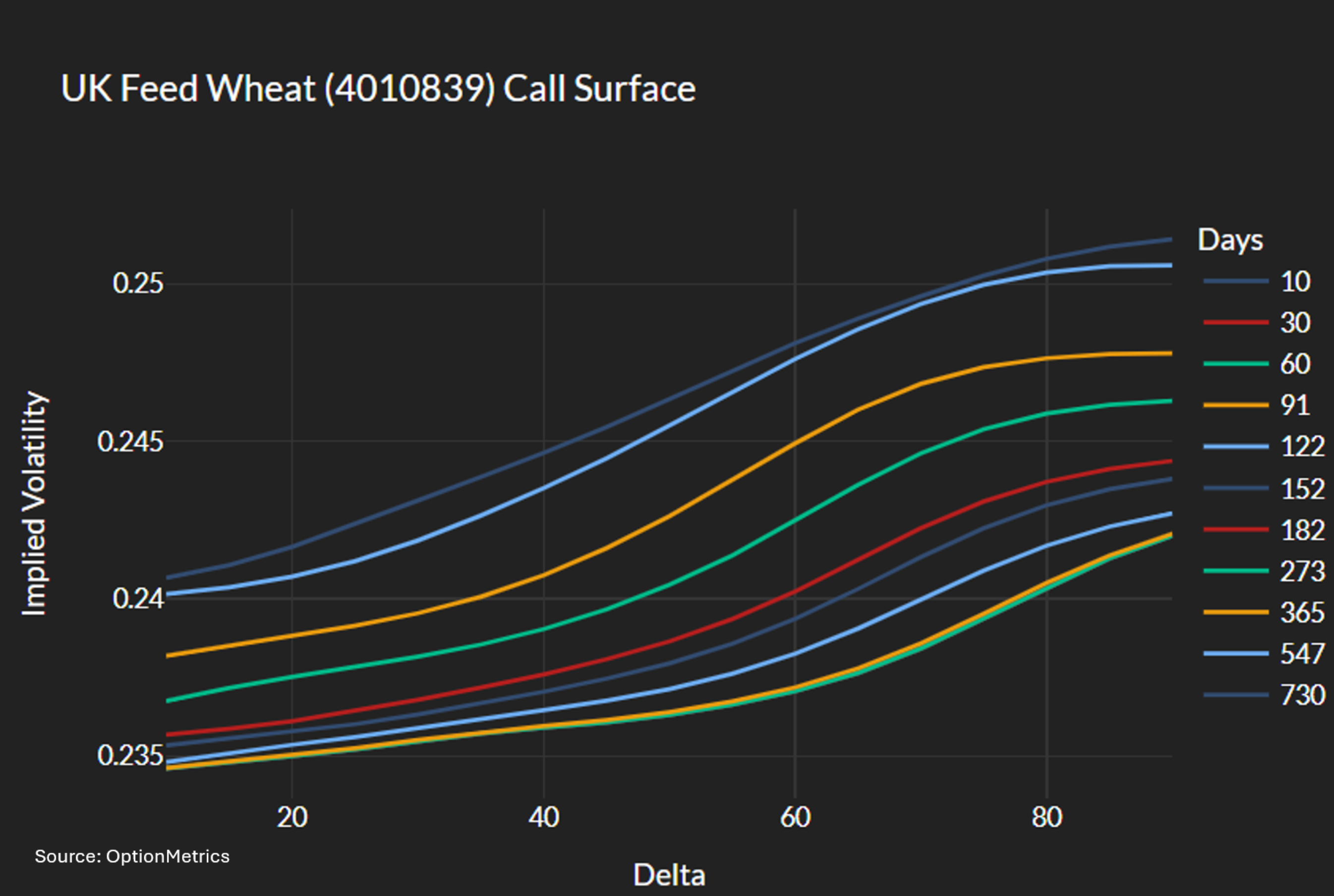

OptionMetrics, an options database and analytics provider for institutional investors and academic researchers worldwide, releases its new IvyDB Futures database with historical futures option pricing data for US and European futures. The database is designed to provide data of the highest quality for financial professionals to perform econometric studies on markets and test option trading strategies.

By OptionMetrics · Via Business Wire · December 18, 2024

OptionMetrics, an options database and analytics provider for institutional investors and academic researchers worldwide, will exhibit at FIA Futures & Options Expo Chicago, November 18-20 at Sheraton Grand Chicago Riverwalk.

By OptionMetrics · Via Business Wire · November 13, 2024

OptionMetrics, an options database and analytics provider for institutional investors and academic researchers worldwide, is announcing its new IvyDB Implied Dividend dataset that uses options pricing data to provide forward-looking dividend projections for optionable single-name securities in the US, two years into the future.

By OptionMetrics · Via Business Wire · October 2, 2024

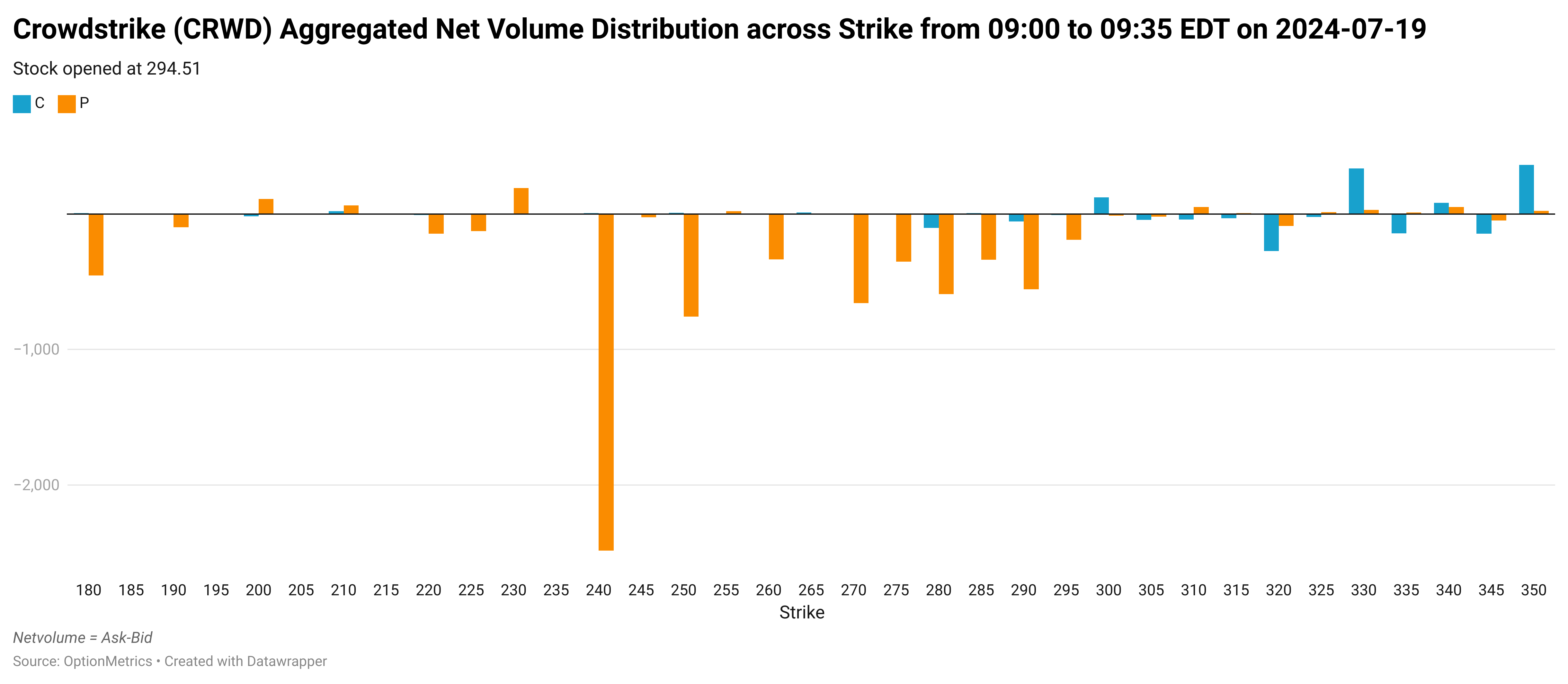

OptionMetrics, an options, equities, ETFs, and futures analytics provider for institutional investors and academic researchers worldwide, releases its new IvyDB Signed Volume intraday dataset, now available in five-minute and 30-minute snapshot intervals throughout the day, in addition to an end of day file. The new dataset gives quants, hedge fund managers, and other institutional investors even more timely insights on retail trading, zero days to expiration (0DTE) options, meme stocks, hedging flows, and other market-making activities.

By OptionMetrics · Via Business Wire · August 6, 2024

OptionMetrics, the first company to compile and license clean, accurate, easy-to-use historical end-of-day data on U.S. exchange-traded equity and index options from January 1996 onward, turns 25 this month. Since its founding, OptionMetrics has been the leading provider of options analytics data, including prices, implied volatilities (IVs), and greeks. Building upon its heritage data sets and capabilities, the company has introduced over the last 25 years a number of products and solutions that deliver empirical insights across an array of global securities and financial markets.

By OptionMetrics · Via Business Wire · June 25, 2024

OptionMetrics, an options database and analytics provider for institutional investors and academic researchers worldwide, will exhibit at BattleFin Discovery Day New York, May 21-22, meeting with alpha seekers and investment funds interested in learning how options, futures, dividend forecasting, and implied beta can help reduce risk and improve investment strategies.

By OptionMetrics · Via Business Wire · May 16, 2024

OptionMetrics Head of Quantitative Research Garrett DeSimone Ph.D. will give a keynote on Risk Neutral Factors – Implied Variance Asymmetry and Beta at Fordham’s Quantitative Conference – QuantVision – on April 4 in New York City.

By OptionMetrics · Via Business Wire · April 3, 2024

OptionMetrics, the leader in financial data and analytics for institutional investors and academic researchers worldwide, releases IvyDB US 6.0 and IvyDB ETF 4.0. Both datasets include even more accurate options implied volatility (IV) calculations and greeks, enhanced index and single stock volatilities, zero meme stock IV caps, and OptionMetrics’ Genie utility for fast, easy data fetch and load capabilities.

By OptionMetrics · Via Business Wire · March 13, 2024

OptionMetrics, the leader in historical options analytics for institutional investors and academic researchers worldwide, is announcing it is sponsoring and exhibiting at Quant Strats, March 12, at Quorum by Convene, New York.

By OptionMetrics · Via Business Wire · March 5, 2024

OptionMetrics, a leading options database and analytics provider for institutional investors and academic researchers worldwide, has integrated ChatGPT-4 artificial intelligence (AI) into its Woodseer Dividend Forecast Data product used by portfolio managers, equity researchers, traders, and others to assess ex-dividend dates, backtest strategies, and anticipate portfolio income.

By OptionMetrics · Via Business Wire · February 14, 2024

OptionMetrics, an options database and analytics provider for institutional investors and academic researchers worldwide, is sponsoring and exhibiting at the Asset Management Derivatives Forum 2024 in Dana Point, California, February 7-9. The conference attracts senior market professionals to discuss the latest in the global derivatives industry. OptionMetrics will showcase its historical equity and futures options and implied volatility data.

By OptionMetrics · Via Business Wire · January 31, 2024

OptionMetrics, an options database and analytics provider for institutional investors and academic researchers worldwide, is sponsoring and exhibiting at Neudata’s New York Winter Data Summit on December 7 at 225 Liberty Street, New York, NY. The conference brings together asset managers, hedge funds, and others to evaluate alternative data for enhancing research, investment management and quantitative analysis. OptionMetrics will showcase its historical equity and futures options and implied volatility data.

By OptionMetrics · Via Business Wire · November 15, 2023

OptionMetrics, an options database and analytics provider for institutional investors and academic researchers worldwide, is announcing it will exhibit at Futures and Options Expo Chicago, FIA, October 2-3 at the Sheraton Grand Chicago Riverwalk, Booth #210.

By OptionMetrics · Via Business Wire · September 29, 2023

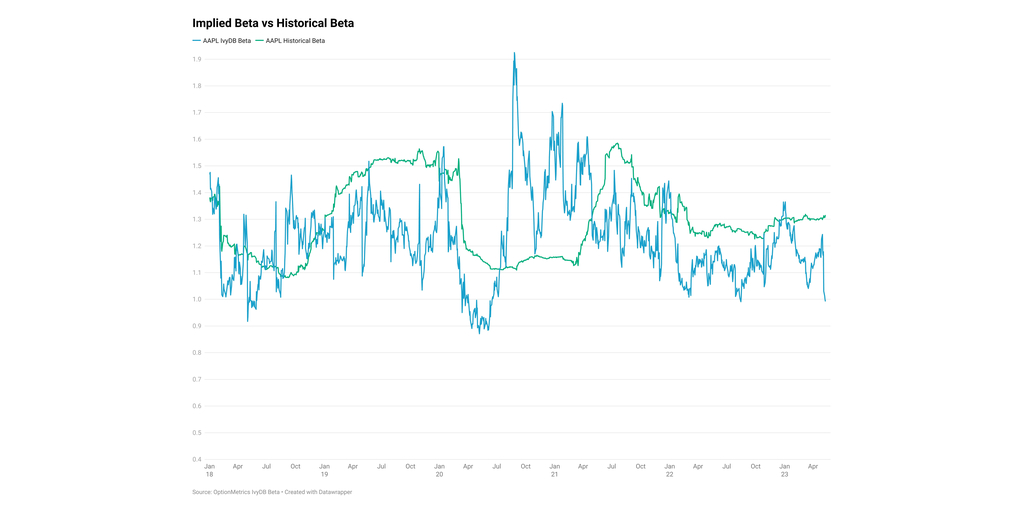

OptionMetrics, a financial data and analytics provider for institutional investors and academic researchers worldwide, is making the world’s first implied beta dataset – IvyDB Beta – available to academic researchers conducting research on equities, systematic risk, factor investing, and other topics. The comprehensive implied beta dataset includes the top 500 SPY constituents and market capitalization single-name US securities from January 2007 onwards and provides a prospective view of the market's perception of systematic risk, a departure from traditional historical beta.

By OptionMetrics · Via Business Wire · September 6, 2023

OptionMetrics, an options database and analytics provider for institutional investors and academic researchers worldwide, is announcing its new IvyDB Beta dataset with comprehensive beta information for the top 500 SPY constituents and market capitalization single-name US securities from January 2007 onwards. This unique dataset enables brokerages, portfolio and risk managers, market makers, hedge funds and others to gain greater insights into the options market's perception of systematic risk (more accurately pricing in impacts of earnings reports, FOMC meetings, CPI announcements, and other events) to forecast returns across securities.

By OptionMetrics · Via Business Wire · June 28, 2023

OptionMetrics, the options and futures database and analytics provider for institutional investors and academic researchers worldwide, is announcing Woodseer Dividend Forecast data for U.S. equities, American depositary receipts (ADRs), and ETFs is now available to academia. The dataset can be leveraged by academia to assess expected dividend payouts, investment strategies, security performance, and more in academic research.

By OptionMetrics · Via Business Wire · June 21, 2023

OptionMetrics, the options and futures database and analytics provider for institutional investors and academic researchers worldwide, has acquired Woodseer Global (“Woodseer”), a provider of dividend forecast data for equities, American depositary receipts (ADRs) and ETFs. The acquisition expands OptionMetrics’ research data offerings and global footprint by adding offices in London and Vancouver. Woodseer is OptionMetrics’ second acquisition since partnering with Leeds Equity Partners (“Leeds Equity”) in 2021. Terms of the transaction were not disclosed.

By OptionMetrics · Via Business Wire · March 28, 2023

OptionMetrics, an options database and analytics provider for institutional investors and academic researchers worldwide, is announcing it will sponsor and exhibit at BattleFin Discovery Day New York, May 17-18. OptionMetrics will also exhibit and speak at Global EQD 2023, May 24-25, Las Vegas. The company’s Head Quant Garrett DeSimone will speak on The Implied Bet Against Beta (IBAB) Factor: A New Frontier for Low-Volatility Investing at Global EQD on May 24.

By OptionMetrics · Via Business Wire · May 15, 2023

OptionMetrics, an options database and analytics provider for institutional investors and academic researchers worldwide, is sponsoring and exhibiting at Neudata’s New York Data Summit on December 1.

By OptionMetrics · Via Business Wire · November 15, 2022

OptionMetrics, an options database and analytics provider for institutional investors and academic researchers worldwide, is announcing it has added Diarmuid Kelleher as Chief Financial Officer and Moti Mizrahi as Vice President, Product & Technology.

By OptionMetrics · Via Business Wire · August 17, 2022

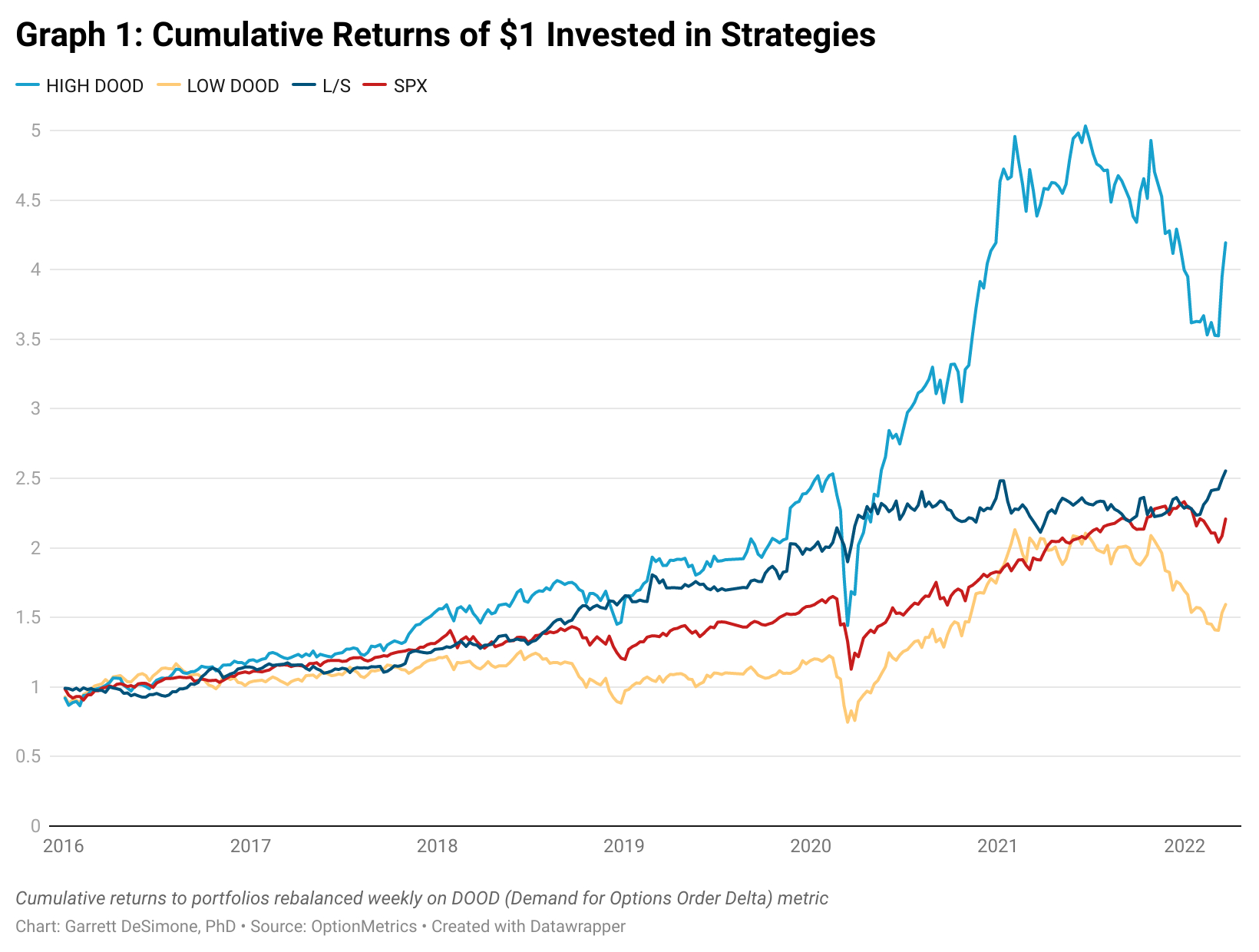

OptionMetrics, an options database and analytics provider for institutional investors and academic researchers worldwide, is announcing Head Quant Garrett DeSimone will speak about option demand at Europe EQD and Global EQD. OptionMetrics will sponsor both conferences, bringing together leading practitioners for substantive research presentations and panel sessions on the latest market views.

By OptionMetrics · Via Business Wire · May 11, 2022

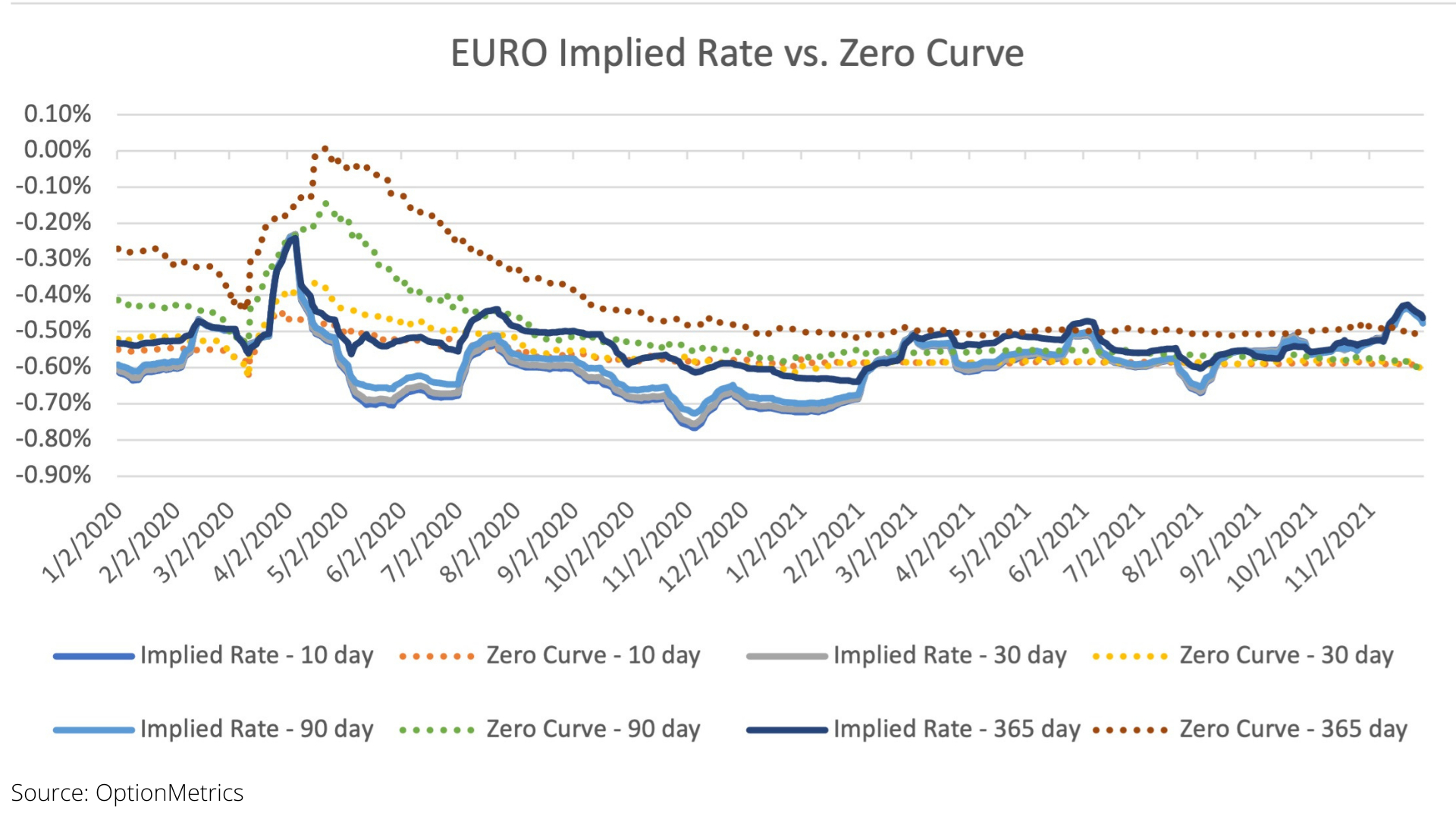

OptionMetrics, an options database and analytics provider for institutional investors and academic researchers worldwide, is announcing its new options implied methodology, offering even greater accuracy in options calculations in the U.S., Europe, Asia Pacific. OptionMetrics replaces the zero curve (used by other providers) with its implied yield curve, constructed with a term structure of overnight rates and implied risk-free rates from options on major indices, for more accurate implied volatility, forward price, index dividend, and borrow rate calculations.

By OptionMetrics · Via Business Wire · February 8, 2022

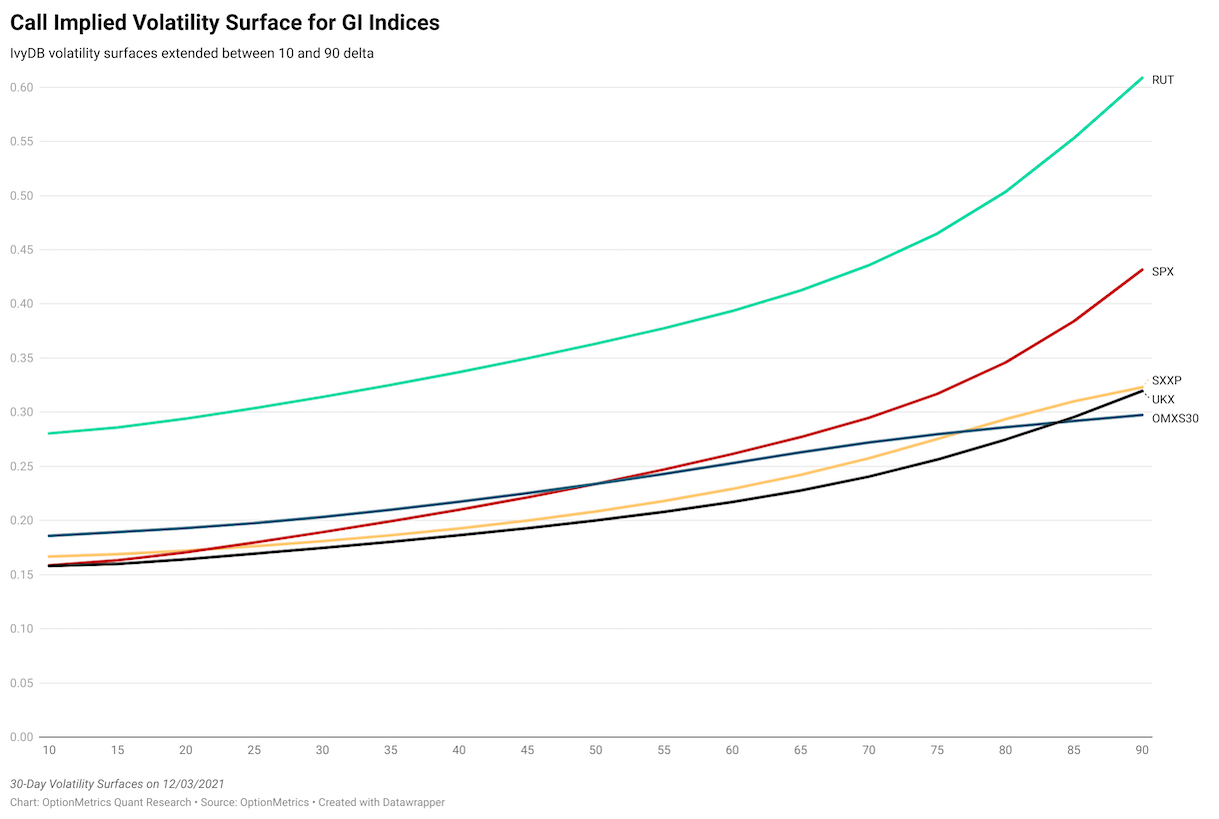

OptionMetrics, an options database and analytics provider for institutional investors and academic researchers worldwide, announces IvyDB Global Indices 3.1. This database offers even more options data across major indices in North America, including the United States and Canada; Europe, and Asia-Pacific, and an expanded volatility surface, enabling better assessments of shorter- and longer-term investing and hedging strategies.

By OptionMetrics · Via Business Wire · December 14, 2021

OptionMetrics, an options database and analytics provider for institutional investors and academic researchers worldwide, announces IvyDB Borrow Rate offering insights on the options-implied costs of short-selling individual securities computed intraday across maturities. The new dataset gives institutional investors and academia valuable information to pinpoint short-selling pressure, analyze dynamic borrowing conditions, and improve research on short-selling positions.

By OptionMetrics · Via Business Wire · September 20, 2021

OptionMetrics, an options database and analytics provider for institutional investors and academic researchers worldwide, releases OptionMetrics IvyDB Canada 3.0 with comprehensive historical price, implied volatility (IV), and sensitivity data on optionable securities across Canadian indices and equity options. Major upgrades to the database include extension of the volatility surface to better assess shorter- and longer-term strategies, and the addition of a forward price table to calculate option values at different maturities.

By OptionMetrics · Via Business Wire · August 2, 2021

OptionMetrics, an options database and analytics provider for institutional investors and academic researchers worldwide, releases OptionMetrics IvyDB Europe 3.0. The update offers new features for institutional investors and academia to assess extreme volatility and complex trading strategies. Major advancements include extension of the volatility surface for underlying securities and the increase in maximum calculated option implied volatility.

By OptionMetrics · Via Business Wire · June 9, 2021

OptionMetrics, an options database and analytics provider for institutional investors and academic researchers worldwide, will be sponsoring and speaking at the fifth annual Global EQD 2021, being held virtually May 26 – 27.

By OptionMetrics · Via Business Wire · May 21, 2021

Leeds Equity Partners (“Leeds Equity”), the New York-based private equity firm, and OptionMetrics, the options and futures database and analytics provider for institutional investors and academic researchers worldwide, announced today that Leeds Equity is investing in OptionMetrics. OptionMetrics represents the first investment platform for Leeds Equity Partners VII, L.P. Terms of the transaction were not disclosed.

By OptionMetrics · Via Business Wire · April 30, 2021

OptionMetrics, an options database and analytics provider for institutional investors and academic researchers worldwide, releases its new IvyDB Signed Volume 2.0 dataset. The dataset now provides even more data on daily option market order flows and buy/sell pressure, and offers insights on retail trading to help quants, hedge fund managers, and other institutional investors improve trading strategy and research.

By OptionMetrics · Via Business Wire · April 7, 2021