D/B/A Compass Diversified Holdings Shares of Beneficial Interest (CODI)

8.2100

+0.00 (0.00%)

NYSE · Last Trade: Feb 26th, 7:23 AM EST

Detailed Quote

| Previous Close | 8.210 |

|---|---|

| Open | - |

| Bid | 7.870 |

| Ask | 8.400 |

| Day's Range | N/A - N/A |

| 52 Week Range | 4.580 - 22.21 |

| Volume | 100 |

| Market Cap | - |

| PE Ratio (TTM) | - |

| EPS (TTM) | - |

| Dividend & Yield | 1.000 (12.18%) |

| 1 Month Average Volume | 1,269,774 |

Chart

About D/B/A Compass Diversified Holdings Shares of Beneficial Interest (CODI)

Compass Diversified Holdings is a private equity firm that specializes in acquiring and managing a diverse portfolio of middle-market businesses across various sectors. The company focuses on long-term value creation through strategic investments in consumer brands, industrial firms, and niche manufacturing operations. By leveraging its experienced management team and strategic insights, Compass Diversified enhances operational performance, drives growth, and maximizes returns for its investors while fostering a sustainable business model. Through its unique structure, it also provides investors with exposure to a range of established and emerging companies within its investment portfolio. Read More

News & Press Releases

Strongly Believes that Structural Discount to Net Asset Value Due to Underperformance and Misalignment of External Manager and Common Shareholders Cannot be Repaired

By ADW Capital Management, LLC · Via GlobeNewswire · February 24, 2026

Compass Diversified (CODI) Earnings Transcript

Via The Motley Fool · January 15, 2026

The company has removed financial information for the years 2022 to 2024 from its website, citing non-reliance.

Via Stocktwits · December 5, 2025

It was a relatively quiet day on Wall Street, but a few stocks made big moves.

Via The Motley Fool · December 4, 2025

Valuing USA Rare Earth stock is about to get much easier.

Via The Motley Fool · December 4, 2025

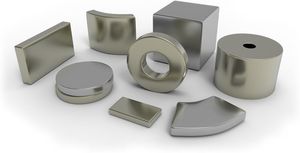

LCM will supply Compass Diversified’s unit Arnold with ex-China rare-earth metals and alloys for advanced permanent magnet production

Via Stocktwits · December 4, 2025

Private equity firm Compass Diversified (NYSE:CODI) is expected to be reporting results next Tuesday after the bell. Here’s what to look for.

Via StockStory · November 30, 2025

Private equity firm Compass Diversified (NYSE:CODI) is expected to be reporting earnings next Tuesday afternoon. Here’s what you need to know.

Via StockStory · November 30, 2025

Private equity firm Compass Diversified (NYSE:CODI) is expected to be announcing earnings results next Tuesday after market close. Here’s what you need to know.

Via StockStory · November 30, 2025

Shares of private equity firm Compass Diversified (NYSE:CODI) jumped 11.1% in the after-market session after the company announced it planned to host a conference call to discuss the restatement of its financial results for the previous three years. Market participants appeared to view the upcoming conference call as a positive step toward finalizing and filing the restated financials. This move was seen as a way to help resolve uncertainties that had caused volatility and delays in the company's filings with government regulators. Also contributing to the market reaction was the news that the company announced it planned to host a conference call to discuss the restatement of its financial results for the previous three years. Market participants appeared to view the upcoming conference call as a positive step toward finalizing and filing the restated financials. This move was seen as a way to help resolve uncertainties that had caused volatility and delays in the company's filings with government regulators.

Via StockStory · November 28, 2025

In an unexpected turn of events, shares of Compass Diversified (NYSE: CODI) experienced a notable ascent on Friday, November 28, 2025, climbing approximately 4.9% ahead of a highly anticipated conference call. This call, scheduled for Thursday, December 4, 2025, is set to address the restatement of the company's financial

Via MarketMinute · November 28, 2025

Over the past six months, Compass Diversified’s shares (currently trading at $6.06) have posted a disappointing 19.4% loss, well below the S&P 500’s 10.4% gain. This may have investors wondering how to approach the situation.

Via StockStory · November 23, 2025

Shares of private equity firm Compass Diversified (NYSE:CODI) jumped 11.2% in the afternoon session after investors grew more optimistic about a potential Federal Reserve interest rate cut in December.

Via StockStory · November 21, 2025

Shares of private equity firm Compass Diversified (NYSE:CODI) fell 3.6% in the morning session after its subsidiary, Lugano Holding, Inc., filed for Chapter 11 bankruptcy protection.

Via StockStory · November 17, 2025

What a brutal six months it’s been for Compass Diversified. The stock has dropped 28.5% and now trades at $5.70, rattling many shareholders. This might have investors contemplating their next move.

Via StockStory · November 13, 2025

What a brutal six months it’s been for Compass Diversified. The stock has dropped 21.4% and now trades at a new 52-week low of $5.52, rattling many shareholders. This might have investors contemplating their next move.

Via StockStory · November 11, 2025

Wall Street rebounded on Monday, recovering part of last week's steep losses as investors grew more confident about risk assets amid encouraging signs from Washington that the record-long government shutdown may soon conclude.

Via Benzinga · November 10, 2025

Compass Diversified’s stock price has taken a beating over the past six months, shedding 64.8% of its value and falling to $6.16 per share. This might have investors contemplating their next move.

Via StockStory · November 3, 2025

Financial firms serve as the backbone of the economy, providing essential services from lending and investment management to risk management and payment processing. But worries about economic uncertainty and potential market volatility have kept sentiment in check,

and over the past six months, the industry's 13.9% return has trailed the S&P 500 by 8.7 percentage points.

Via StockStory · October 31, 2025

Compass Diversified’s stock price has taken a beating over the past six months, shedding 61.9% of its value and falling to $6.55 per share. This might have investors contemplating their next move.

Via StockStory · October 31, 2025

Private equity firm Compass Diversified (NYSE:CODI) is expected to be reporting earnings next Friday after market close. Here’s what you need to know.

Via StockStory · October 29, 2025

Bragar Eagel & Squire, P.C. Litigation Partner Brandon Walker Encourages Investors Who Suffered Losses In Compass (CODI) To Contact Him Directly To Discuss Their Options

By Bragar Eagel & Squire · Via GlobeNewswire · October 29, 2025

A number of stocks fell in the afternoon session after new trade tensions and disappointing earnings from major tech companies weighed heavily on investor sentiment.

Via StockStory · October 22, 2025

Via Benzinga · October 17, 2025

Via Benzinga · October 13, 2025