Target Corp (TGT)

116.44

+0.00 (0.00%)

NYSE · Last Trade: Feb 26th, 5:22 AM EST

Detailed Quote

| Previous Close | 116.44 |

|---|---|

| Open | - |

| Bid | 115.35 |

| Ask | 116.66 |

| Day's Range | N/A - N/A |

| 52 Week Range | 83.44 - 127.89 |

| Volume | 817 |

| Market Cap | 57.61B |

| PE Ratio (TTM) | 14.13 |

| EPS (TTM) | 8.2 |

| Dividend & Yield | 4.560 (3.92%) |

| 1 Month Average Volume | 6,285,776 |

Chart

About Target Corp (TGT)

Target Corp is a leading retail company in the United States that offers a wide range of products including clothing, electronics, groceries, and household goods. Known for its commitment to providing a fun and accessible shopping experience, the company operates a vast network of stores across the country, along with an online platform that allows customers to shop conveniently from home. Target focuses on delivering high-quality merchandise at competitive prices, and it engages in various initiatives to enhance sustainability and community engagement. The company's blend of trendy design, value, and customer service has made it a popular destination for consumers of all demographics. Read More

News & Press Releases

The American consumer is proving more resilient than many on Wall Street dared to hope. In a surprise turn of events, the Conference Board reported on February 25, 2026, that its Consumer Confidence Index climbed to 91.2 in February, a significant jump from January’s revised reading of 89.

Via MarketMinute · February 25, 2026

In a landmark decision that has sent shockwaves through the global trade ecosystem, the Supreme Court ruled 6-3 on February 20, 2026, to strike down the White House’s "Liberation Day" emergency tariff program. The Court found that the administration overstepped its constitutional authority by using the International Emergency Economic

Via MarketMinute · February 25, 2026

BENTONVILLE, AR — As of February 25, 2026, the retail landscape has reached a historic turning point. Walmart (NYSE: WMT) has officially crossed the $1 trillion market capitalization threshold, a milestone fueled not just by grocery sales, but by its emergence as a global leader in "Agentic AI" and autonomous logistics.

Via MarketMinute · February 25, 2026

On January 28, 2026, the financial world witnessed a historic milestone as the S&P 500 Index (NYSEARCA: SPY) breached the 7,000-point threshold for the first time in history. Reaching an intraday high of 7,002.28, the index’s ascent from the 6,000-point mark took a mere

Via MarketMinute · February 24, 2026

As the final week of February 2026 unfolds, a massive wave of capital is beginning to flood the U.S. economy, marking the start of what economists are calling the "Spring of Stimulus." Following the full implementation of the One Big Beautiful Bill Act (OBBBA)—officially titled the Working Families

Via MarketMinute · February 24, 2026

In a seismic shift for global trade and constitutional law, the Supreme Court of the United States ruled on February 20, 2026, that the executive branch lacks the authority to unilaterally impose broad-based tariffs under the International Emergency Economic Powers Act (IEEPA). The 6–3 decision in the consolidated cases

Via MarketMinute · February 24, 2026

NEW YORK — As the calendar turns to late February 2026, the American consumer is proving to be more resilient than many economists predicted just six months ago. The catalyst for this unexpected strength is the "One Big Beautiful Bill" Act (OBBBA), a landmark piece of fiscal legislation that has effectively

Via MarketMinute · February 24, 2026

As the dust settles on Walmart's (NYSE: WMT) blockbuster fourth-quarter earnings report, the retail giant has not only exceeded market expectations but has also set the stage for what analysts are calling a "spring of stimulus." While the official earnings call took place on February 19, the market is still

Via MarketMinute · February 24, 2026

As of February 24, 2026, the fixed-income market is witnessing a historic anomaly that has confounded traditional macroeconomic models. The iShares 20+ Year Treasury Bond ETF (NASDAQ: TLT) is holding firmly onto a significant upside breakout, even as the U.S. Dollar Index (DXY) teeters on the edge of a

Via MarketMinute · February 24, 2026

In a dramatic escalation of international trade tensions, the global economic order has been thrown into disarray this week following a series of rapid-fire developments in Washington D.C. On February 24, 2026, the European Commission officially announced the freezing of all ratification processes for the landmark "Turnberry Deal," while

Via MarketMinute · February 24, 2026

WASHINGTON, D.C. — In a dramatic reshuffling of global trade policy, the Trump administration has officially transitioned its sweeping tariff regime to the "Balance-of-Payments" authority under Section 122 of the Trade Act of 1974. This move, finalized on February 24, 2026, comes as an immediate response to a stinging defeat

Via MarketMinute · February 24, 2026

In a landmark decision that has sent shockwaves through global supply chains and the halls of power in Washington, the U.S. Supreme Court ruled 6–3 on February 20, 2026, in Learning Resources, Inc. v. Trump that the executive branch overstepped its constitutional authority by using the International Emergency

Via MarketMinute · February 24, 2026

In a dramatic shift that has sent shockwaves through global markets, President Trump has announced a new 15% global tariff surcharge, invoking the seldom-used Section 122 of the Trade Act of 1974. The move, announced late yesterday, serves as an aggressive "legal bridge" following a landmark Supreme Court ruling that

Via MarketMinute · February 24, 2026

The global trade landscape underwent a seismic shift at 12:01 a.m. EST on February 24, 2026, as the United States officially implemented a 10% global import tariff under Section 122 of the Trade Act of 1974. This move, characterized as a "Plan B" by the administration, comes just

Via MarketMinute · February 24, 2026

In a monumental decision that has sent shockwaves through global capitals and Wall Street trading floors, the Supreme Court ruled 6-3 on February 20, 2026, that the President cannot use the International Emergency Economic Powers Act (IEEPA) to unilaterally impose global tariffs. The case, Learning Resources, Inc. v. Trump, effectively

Via MarketMinute · February 24, 2026

In a week defined by unprecedented institutional friction and market volatility, precious metals have surged to historic highs as investors flee toward safe-haven assets. The catalyst for this dramatic rally was a dual-pronged shock to the global trade system: first, a monumental U.S. Supreme Court ruling that stripped the

Via MarketMinute · February 24, 2026

WASHINGTON, D.C. — The global trading order has descended into a state of unprecedented paralysis this week as the Trump administration’s sudden pivot to a 15% universal import surcharge triggered an immediate and fierce international backlash. By February 23, 2026, the diplomatic "peace-for-security" deals painstakingly negotiated over the past

Via MarketMinute · February 23, 2026

The United States Supreme Court delivered a stunning blow to the administration’s trade agenda on Friday, February 20, 2026, striking down the use of the International Emergency Economic Powers Act (IEEPA) to bypass Congress in the imposition of broad-based national tariffs. In a 6-3 decision, the Court ruled that

Via MarketMinute · February 23, 2026

The global financial markets are reeling this Monday, February 23, 2026, as a historic "tariff whiplash" has sent the benchmark 10-year Treasury yield tumbling to its lowest level in three months. In a classic "flight to quality," investors are aggressively rotating out of riskier assets and into the safety of

Via MarketMinute · February 23, 2026

The retail world is currently processing a whirlwind of data after Walmart Inc. (NYSE: WMT) released its fourth-quarter fiscal 2026 earnings on February 19, 2026. The report, which surpassed analyst expectations across nearly every key metric, offers a vital window into the state of the American shopper following a year

Via MarketMinute · February 23, 2026

In a weekend move that has sent shockwaves through global markets, President Donald Trump announced a new 15% global import surcharge, invoking the long-dormant Section 122 of the Trade Act of 1974. The announcement follows a stinging defeat at the Supreme Court on Friday, February 20, 2026, which invalidated the

Via MarketMinute · February 23, 2026

In a landmark 6–3 decision that has sent shockwaves through the global economy, the United States Supreme Court ruled on February 20, 2026, that the President cannot unilaterally impose sweeping tariffs under the International Emergency Economic Powers Act (IEEPA). The decision in the consolidated cases of Learning Resources, Inc.

Via MarketMinute · February 23, 2026

The dream of a "pivot" to lower interest rates in early 2026 has been dealt a staggering blow following the release of the latest Personal Consumption Expenditures (PCE) price index. On February 23, 2026, investors are grappling with data that confirms inflation is not merely "sticky" but potentially re-accelerating, forcing

Via MarketMinute · February 23, 2026

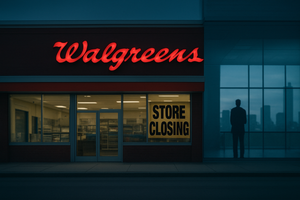

DEERFIELD, IL — February 23, 2026 — In a move that underscores the continued volatility of the American retail pharmacy landscape, the newly private Walgreens Boots Alliance has announced a significant expansion of its workforce reductions and a finalized timeline for its massive store closure initiative. Under the leadership of the private

Via MarketMinute · February 23, 2026

WASHINGTON D.C. — In a weekend that has fundamentally reshaped the American economic landscape, President Trump has officially signed an executive proclamation raising global tariffs to a uniform 15%. This aggressive maneuver follows a Friday afternoon bombshell from the Supreme Court, which struck down the administration's previous "reciprocal" tariff framework.

Via MarketMinute · February 23, 2026